Walk with me while I debunk the idea that gross return percentage accurately predicts salvage value.

Walk with me while I debunk the idea that gross return percentage accurately predicts salvage expectation.

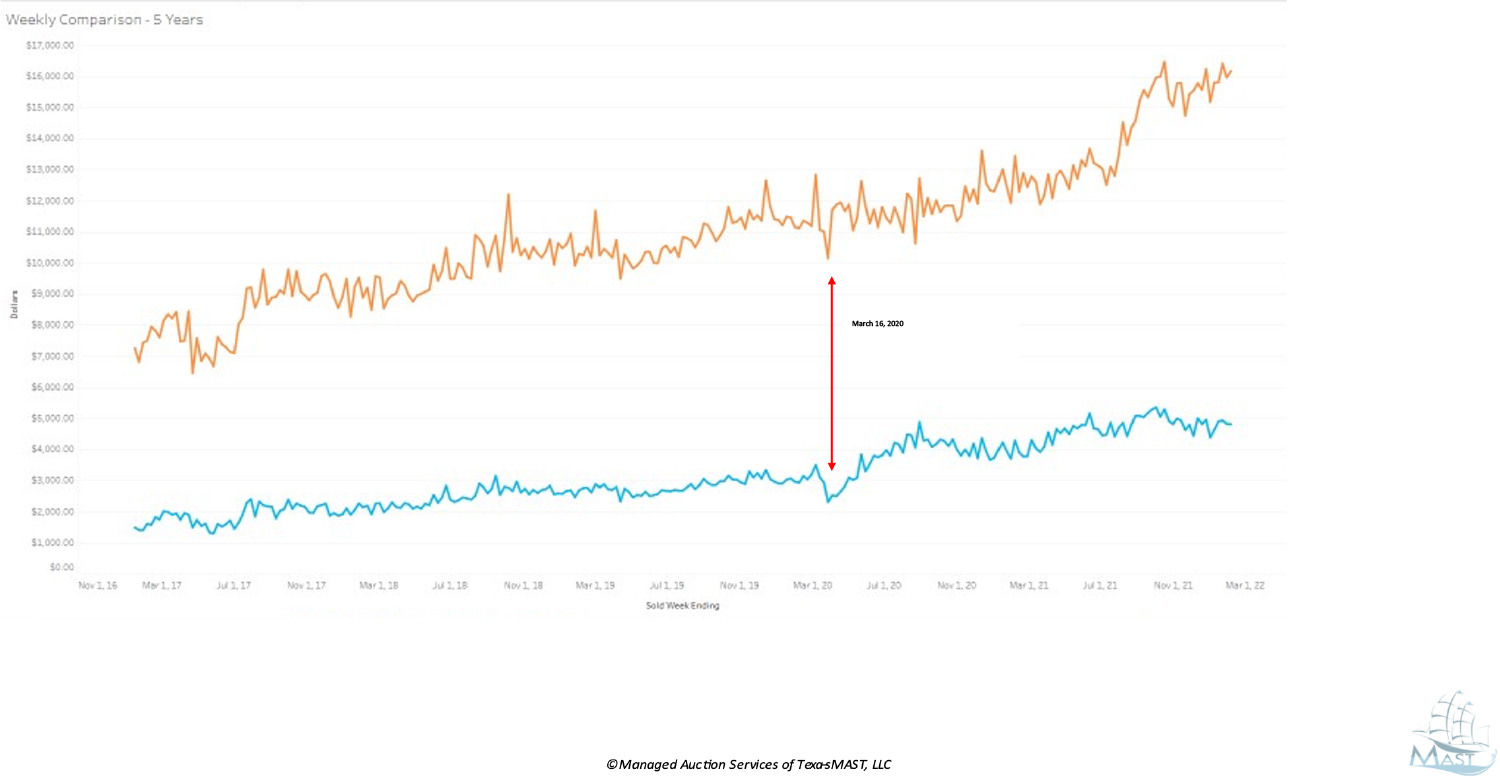

On March 16th, 2020, a stay-at-home order was mandated. Uncertainty about what this meant for the future was felt in every household, and it was at the forefront of every conversation. The early reaction of the financial markets was a visible result of how the American people felt as this virus and potential repercussions took hold.

Meanwhile, in the salvage sector, we were staying home. Without cars on the road, there were no accidents. Salvage inventory was reduced by ½ overnight and lasted into the summer of 2021.

Simultaneously, confidence in the financial market began to level out, and buyer demand returned quickly. The fundamental law of supply and demand took effect.

Salvaged inventory was reduced by half, impacting volume/opportunity on used car lots.

Stay-at-home orders halted production lines for new vehicles.

Chip shortages crippled the already limping supply of new retail.

With no inventory to be had and a voracious buyer appetite, new and used retail prices skyrocketed. And salvage returns at auction increased right alongside. Car dealers were in desperate competition to keep their lots full, satiate consumers, and capitalize on a historic market surge.

These events had a monumental impact on P&C Insurers. Can you recount how many watercooler conversations you had about the spike in settlement values?

Following an event like Covid, it’s essential to interpret the market correctly to maximize recovery efforts and, more importantly, mitigate your loss exposure. When a short cycle market change occurs, we can bring current pricing trends into review based on historical auction results.

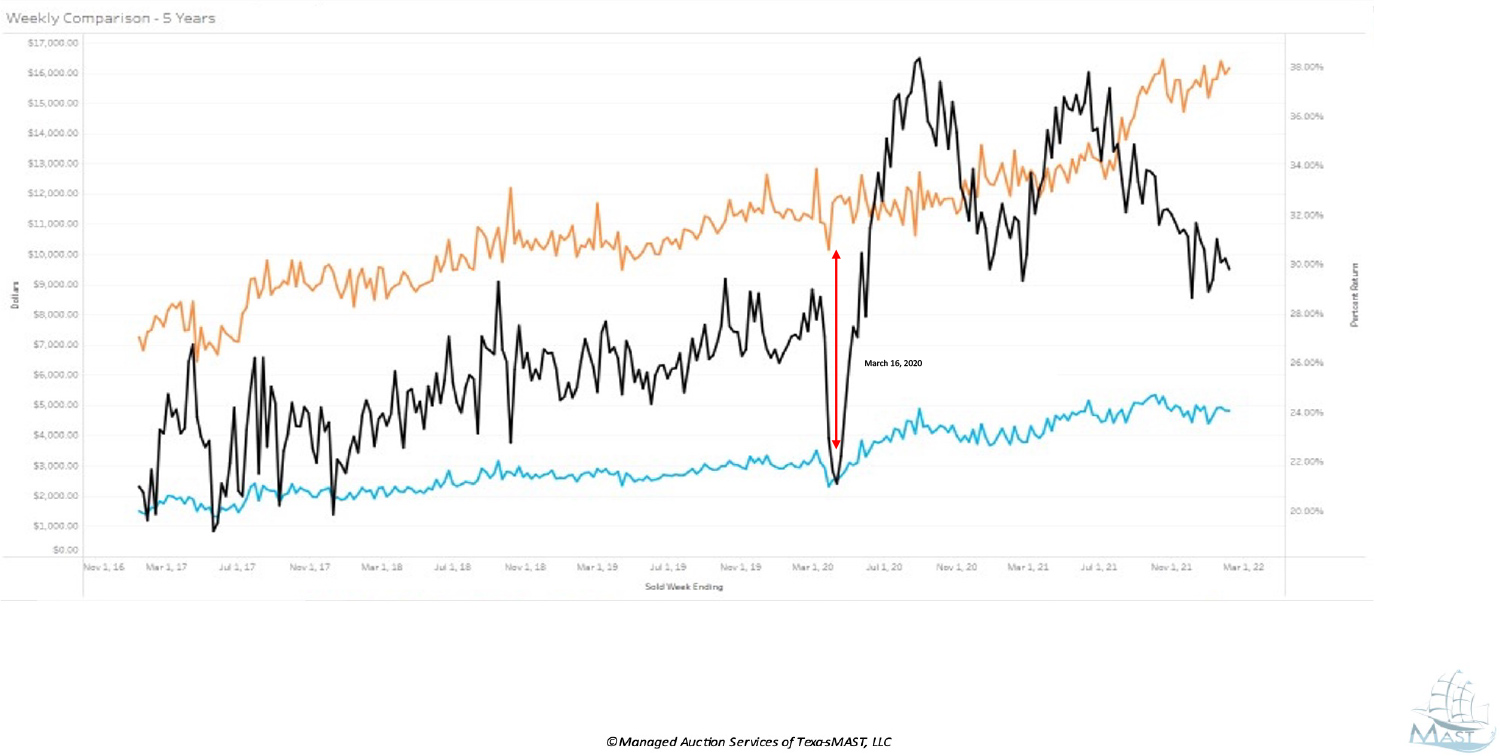

The trend line below shows average vehicle pricing in ACV (orange) and salvage purchase price (blue) for the last five years. They are both increasing over time.

But, because these values, ACV and salvage purchase price, are often not rising at the same rate, the proportional relationship in gross return change (black) is dramatic. They have a significant impact on the week-over-week gross return percent expectation.

In April of 2020, after the financial rebound, the industry witnessed a sharp increase in auction recovery dollars resulting in a spike in the gross return %. In July, settlement values increased and the gross return % plummeted even though auction recoveries continued to rise. A few months later, our market valuation partners responded with increases to the ACV bands, and gross return reacted again.

Basing salvage value purely on gross return predictions is unreliable because of the volatility in the proportional relationship (shown above). However, suppose we were able to compare today’s settlement value to the known resolution 90 days from now once the claim was processed. In that case, we might be closer to relying on gross return as the standard prediction metric. But unfortunately, that is not how it works in application.

Instead, we should concentrate on static pricing trends. What is happening in the pricing market? Or, in other words, how much did a comparable unit bring yesterday? Shifting your focus to asset valuation and determining a realistic expectation for what the unit would likely bring in auction recovery dollars will have a multiplier effect on your process. Adjusting your forecasting efforts will increase accuracy rates on repair/replace decisions and avoid undervalued resolutions.

Similar shifts were seen on this trendline back in 2009 when the housing bubble burst and Wallstreet reacted. The war on Ukraine, the increased gas prices, and the movement to electric vehicles all impact pricing trends.

MAST adopted a few standard operating procedures to our auction management practice that shaped our success. We evaluate pricing trends in a 7-day sprint, tracking market fluctuations weekly. We round table observations from the previous week’s cycle to better anticipate the coming week’s successes. There is little to no emphasis on the gross percentage of ACV in our review process. Instead, we fixate on recovery dollars to set an expectation for future auction performance.