Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

August 2022

Happy Monday, everyone. In August, we like to do something different with our monthly reports. Fall is almost in the air.

If your heart is beating at a quickened pace this time of year, it’s probably due to 1 of 2 things — either you forget then re-remember football is right around the corner as you’re bombarded with commercials and office chatter every 5-10 minutes, and your heart is ramping up with excitement, or you are constantly annoyed at people that won’t stop talking about football being right around the corner, and your frustration level is rising every 5-10 minutes. I sincerely apologize if you are in that latter group. 😁

If you remember this time last year, we leaned hard into the football chatter — specifically, the fantasy football chatter, to offer a bold prediction for the salvage market as 2021 wound down. Why? Well, first and foremost, we are data nerds here at MAST. Secondly, there are a lot of similarities between vehicle salvage and fantasy football. Both fantasy sports and the auto recycling industry are valued at over $20 billion worldwide. In fantasy sports and salvage returns, past performance is often an indicator of future results. And most importantly, success in fantasy sports and salvage are driven by sell-high opportunities grounded in accurate expectations of value. Salvage and fantasy, where accuracy matters.

Before we dive into bold predictions, on behalf of the football (and fantasy football) community out there, let me pause quickly and clarify the difference between a bold prediction and a regular one. A bold prediction is about projecting something that you believe is possible- and perhaps even likely- well before there is enough concrete evidence to determine that the projection is absolute. Bold predictions are somewhat of an educated long-shot. In the football and salvage community alike, the idea is to spot something that could make or break our season before everyone else is wise to it. A bold prediction should be a fun assertion grounded in fact but carries a high degree of speculation.

Okay. Here we go. Let’s start with last fall’s bold prediction:

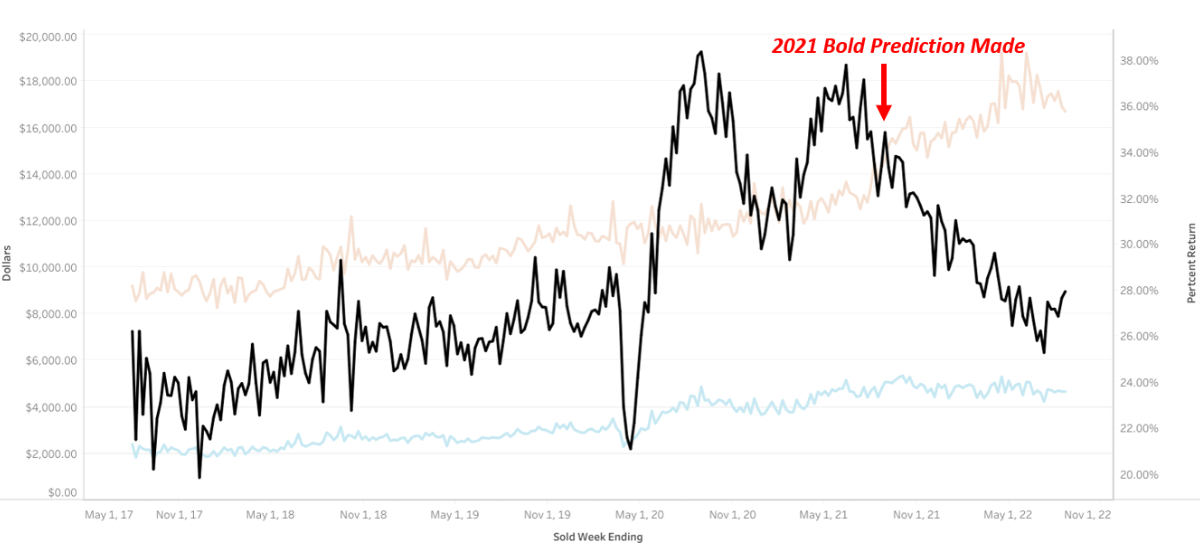

Even though the market has been in decline for the previous two months (including through August), we believe that right now, we are on the precipice of a third prolonged market upward swing since Covid entered all of our lives back in the spring of 2020.

We believed that September to November 2021 would be marked by a rapid course correction in the market or an increase because the three months preceding that period saw a salvage market return decrease even though vehicle pricing (wholesale and retail) had not fallen dramatically. Vehicle inventory levels depleted significantly during that period. The only other times this had happened were the summer of 2020 and the spring of 2021. We speculated that while salvage returns had dipped for a few months, retail pricing remained elevated as consumer demand increased — so surely salvage buyers would be encouraged by high resale prices and high demand and offer more at auction for the fall of 2021.

So how did that pan out? Well…

So what happened? We weren’t off with our claim in terms of auction purchase prices. Salvage purchase price rose 11.3% for 90 days (from $4427 on 8/15/21 to $4926 on 11/15/21) before falling 5% for the next nine months to today’s purchase price ($4672 week ending 8/14/22). So there definitely was a prolonged pop in auction results before falling again, though not nearly as high as the summer of 2020 (94.6% increase in auction purchase) or the spring of 2021 (36.5% increase in auction purchase).

But in the graphic above, the bold black line represents gross return recovery (as % of gross auction return relative to claim settlement value). That proportional relationship is primarily driven by the rate of change between ACV and Gross Return Dollars (auction purchase price). We just didn’t anticipate that claim settlement and auction purchase price would increase at such a disproportionate rate. Gross Return Dollars may have gone up 11.3% for the 90 days following last year’s bold prediction, but industry ACV jumped 14.4% during that period. So even though auction purchase saw a short-term increase, the gains weren’t outweighed by the increased claim settlement values causing us to whiff on our gross return increase projection in last year’s bold prediction.

Which brings us to…

Bold Prediction 2022: The holidays will bring yule-tide salvage results as December 2022 return % will be higher than any month in Q3 of 2022.

To be clear, since 2009, when MAST was founded, this has never happened. The salvage market has been predictably cyclical (with the exception of 2020 & 2021), and the month of December has always been a seasonal low point. Meanwhile, July to September has historically been the second of two annual peaks in consumer purchasing behavior. So why the claim about a high December?

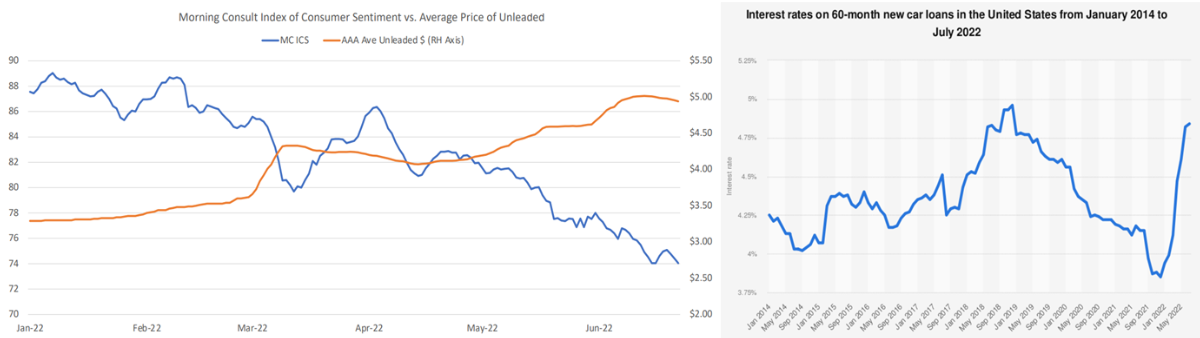

Firstly, consumer sentiment is at a 16-month low (since February 2021). This results from several macroeconomic factors, including the unemployment rate and inflation, and a few variables slightly more tangential to the automotive industry—namely, rising interest rates on vehicle loans and elevated fuel costs. Cox Automotive shared an exciting graphic in their Mid-Year 2022 report correlating consumer sentiment with the national average for a gallon of unleaded gas (below left). Meanwhile, nearly every month in 2022 has seen an increase in interest rates for vehicle lending.

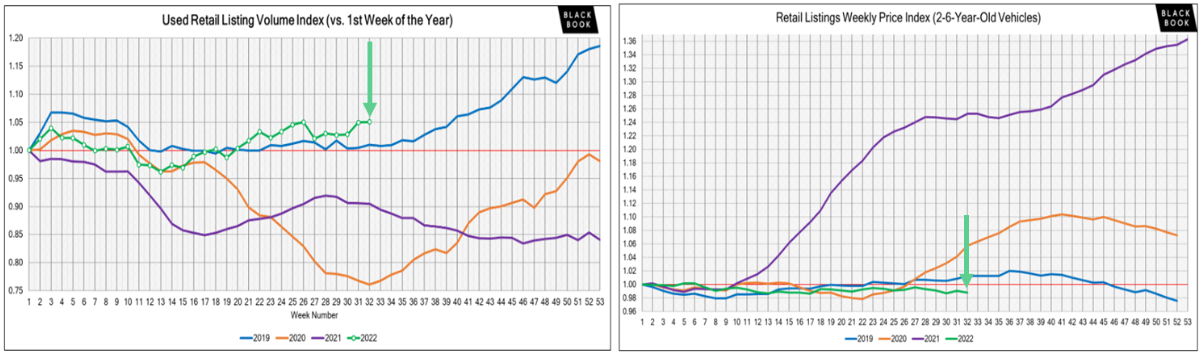

Between high-interest rates and high gas prices, no one is excited about buying a car right now. As a result, used retail inventory has steadily climbed (bottom left), even though used retail pricing has dropped (bottom right). This is not normal. Typically retail price changes have an inverse relationship with used retail volume.

Salvage buyers are very apprehensive about buying rebuildable vehicles if they don’t know how quickly they will sell their rebuilt cars. There are already a few minor signs that perhaps consumer sentiment might rebound in the later half of 2022. Cheaper gas could be coming, and unemployment rates could be subsiding.

It’s still too early to tell if we are pulling out of the economic spiral plaguing the first half of 2022, but the heart of our 2022 Bold Prediction and a high gross return in December is that we will. Although it’s happening at different rates across different vehicle classes, according to CarGurus, retail pricing is already down 0.2% since the beginning of August. This is the same type of information that drives CCC, Mitchell, and NADA vehicle valuations. If this continues, you will finally start paying slightly less on your claim settlement. Typically this would also mean salvage buyers will be paying less at auction, but the consumer sentiment data suggests there could be a healthy amount of pent-up vehicle demand. Additionally, the buyers at salvage auctions have been significantly more conservative with their pricing adjustments than the retail market. From 8/15/2021 to 8/14/2022, claim settlement value on vehicles sold at auction (ACV) has increased 22.6%, while auction purchase prices have only risen 5.5%. In fact, claim settlement value on vehicles sold at auction (ACV) has risen 3.0% since April, while auction purchase prices have fallen 8.5%. Increased consumer sentiment should restore salvage buyer faith.

If claim settlement values begin dropping now and consumer sentiment returns and the average industry cycle time from assignment to settlement remains at 89.0 days, then gross return percent should start climbing in November and make for a December that is stronger in terms of gross return % that is better than every month in Q3. Including the July results summarized below. It’s a bold claim, but it feels like it could happen.

In the meantime, here is a summary for the month of July:

3,273 Total Vehicles Sold with a gross return of 26.8%

$1,494,188 in auction increases realized for an increase to gross (MAST factor) of 2.65%

Average gain of $900.98 per initial rejected bid and a success rate of 91.5%

$7,831,381 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Assessing severe damage from a buyer’s perspective allows for focus on value, not damage. Major Auto recyclers like LKQ employ ‘reverse’ estimates to determine the remaining value of undamaged part assemblies, driving their expectations for auction performance and the amount of money they are willing to spend. This type of assessment helps to highlight the value of units like this 2016 Silverado 3500. The collision it was involved in was so shockingly severe that it nearly severed the truck into two pieces. But a quick assessment of used retail market prices for significant assemblies like the engine ($7500), transmission ($4000), and two passenger door assemblies ($1400) paint a quick picture of potential salvage value despite the severity of the damage. While a salvage buyer will likely incur transportation and disassembly costs in advance of their part assembly resale, an initial auction of $4600 was too low based on the assembly part prices. This type of research can set you up for an easy decision to decline a low offer and facilitate a higher return. This unit sold for $6,900—a $2300 increase for 15 minutes of research.

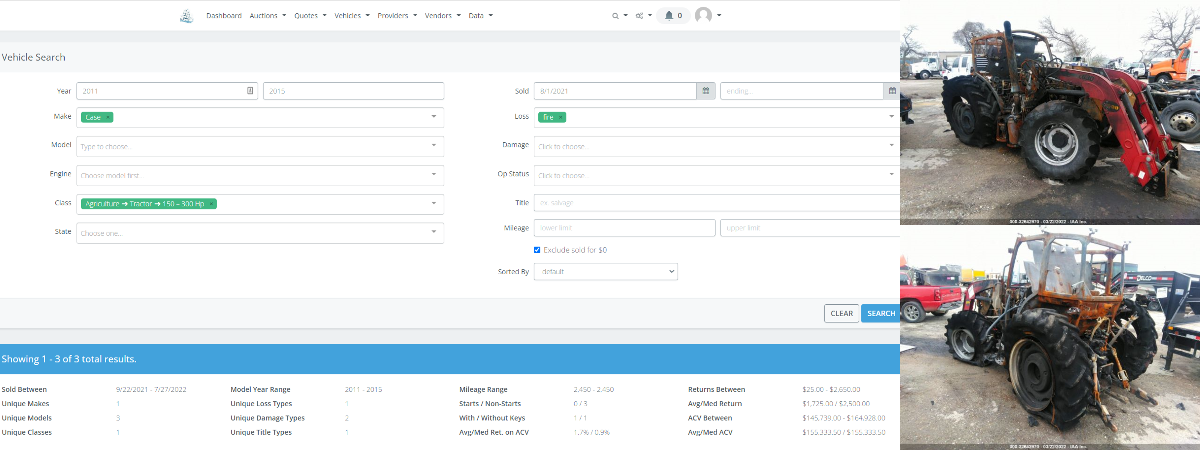

No salvage is new salvage. It’s harvesting season, which means fire losses on Ag equipment are in full swing, and looks can be deceiving. Don’t write off salvage value because historical examples are difficult to come by. Your claims team needs to rely on a tool that will share comparable salvage examples on anything you insure, even a crispy 2015 Case IH 120C Utility tractor. When the tool says $2500, please don’t give it away or even sell it for less (the initial auction high bid on this one was $1125); trust it. As predicted, a salvage buyer stepped up and paid $2500 for this toasty tractor.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.