Our Results

Our Results

As competition increases among auto insurers to offer lower rates and rapid claim resolution, many claim handling organizations have turned to tech-enabled solutions to maximize bottom-line performance.

MAST provides our clients with measurable increases to salvage recovery, improved total loss decision-making, and accurate expectations for future salvage market performance.

Measurable Increases to Salvage Recovery at Auction

Measurable Increases to Salvage Recovery at Auction

Since 2009, MAST has studied the volatility of the salvage auction. Many variables influence a salvage buyer’s decision to raise or lower their bid, but uniformly they purchase through the auction with one goal in mind: spend as little as possible.

The dynamics of the auction drive bids up due to competition among buyers, and innovation from auction vendors have widened the purchasing audience to worldwide engagement, but 1 in 4 vehicles sold through auction still offer salvage buyers precisely what they came to the auction for in the first place: a discount.

By reviewing a vehicle provider’s salvage assets in advance of the auction and determining a market expectation for each, MAST can identify auction under-performance quickly and facilitate an immediate opportunity for negotiation or subsequent auction exposure with a 91.0% success rate for positive auction return improvement.

Last year the cumulative effort of these auction performance improvements resulted in an additional $9.03 million in salvage recovery dollars for our clients.

Improved Total Loss Decision Making

Improved Total Loss Decision Making

The most critical decision around any high severity damage claim is whether repair or replacement is the most cost-effective option for a claims organization.

A large part of that decision centers around expectations for salvage value. Salvage quotes can influence multiple aspects of claim handling. An accurate salvage value expectation can improve communication with vehicle owners, minimize storage fees at a body shop, reduce unnecessary tear-down operations, and even enable subrogating reps and arbiters to increase or justify recovery efforts.

Salvage quotes from MAST offer claims organizations an improvement over their solutions on all vehicle claims, including passenger, commercial transport, agricultural equipment, construction equipment, and recreational vehicles.

If it can move, we can quote it. All quotes include multiple comparison units, a narrow range of expectations for salvage performance at auction, and a narrative explaining the salvage projection to assist claim handling reps in conversation with vehicle owners or subrogating reps as they document salvage expectations.

Most claim organizations incur 60-90 days of processing time from decision to total to receipt of auction proceeds. All quotes from MAST are driven by recent and expected future market performance. Our quotes enable a claim organization to make repair/replace decisions today based on what an individual vehicle will sell for tomorrow.

Additionally, all quoted vehicles are tracked through the auction to ensure quote expectations are met, and accuracy variance on salvage quotes from MAST are measured and reported quarterly to maintain confidence in claim handling decisions.

Accurate Expectations for Future Salvage Performance

Accurate Expectations for Future Salvage Performance

It is more expensive than ever to replace a vehicle. Yet, due to rising costs associated with repairs and damage severity, many claim organizations are reporting as much as 20% of all losses reported result in a total loss resolution. The volume of reported losses affected by total loss decisions has a significant impact on claim reserves.

A claim organization’s ability to accurately assess average claim cost can be the difference between premium adjustments and high growth in policy sales or claim leakage and ultimately a disappointing balance sheet at the end of a quarter.

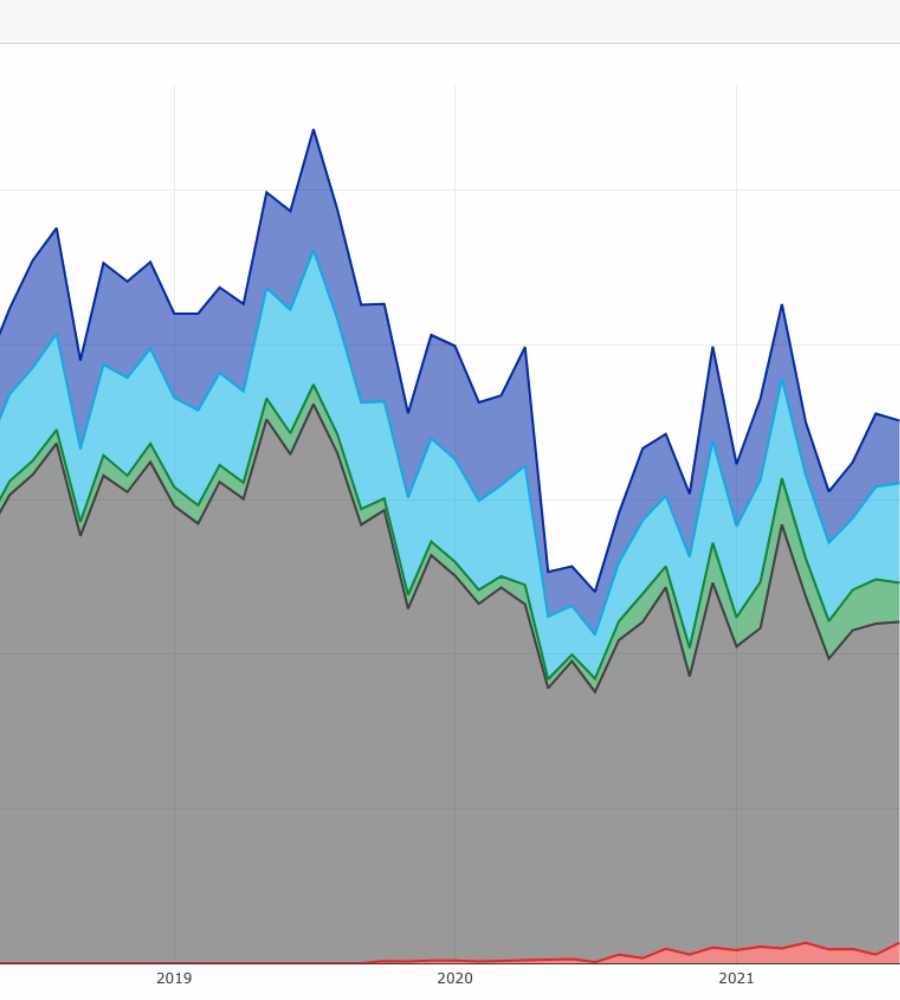

Future anticipated salvage returns are a fundamental aspect of accurate claim reserves. Our clients rely on monthly and quarterly reporting to project near-term expectations of the salvage market. In May 2020, we accurately forecasted a prolonged increase in salvage returns as financial markets fell and auto claim volume halted immediately following the Covid-19 outbreak.

In June 2021, we accurately projected the end of the stratospheric auction results as used retail volume began to recover, and wholesale vehicle pricing began to dip. Several macroeconomic influences shape the salvage vehicle market that extends well beyond make/model, impact point, and damage severity.

We assist our clients with metrics to track those influences and offer expectations for future salvage performance.