Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

April 2023

Happy Monday. It’s the end of tax season. Hopefully, that sentence doesn’t have you scrambling for Pepto. (Sorry if so). But it’s an integral part of the salvage market annual cycle, so it’s where we want to start the discussion this month.

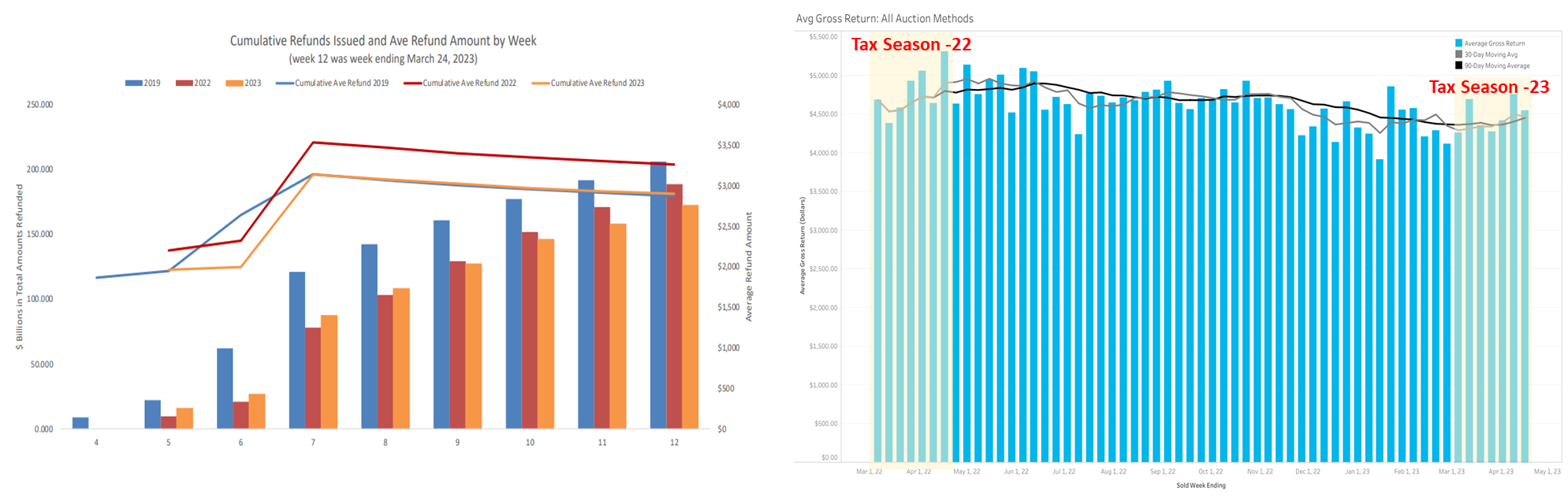

Last week, during the Cox Automotive used vehicle value index quarterly call, it was suggested tax refund amounts were down substantially in 2023. 9% fewer refunds have been disbursed than last year, and the average tax refund is down 11% (below left). Most domestic salvage markets see a boon in auction purchase prices through tax season. 2023 has followed the same historical pattern, but this year’s comparative increases have been mild. In 2022 the average salvage purchase price increase from the first week of March through the second week of April jumped 13.4%. This year the increase during that same period has been only 6.7% (below right).

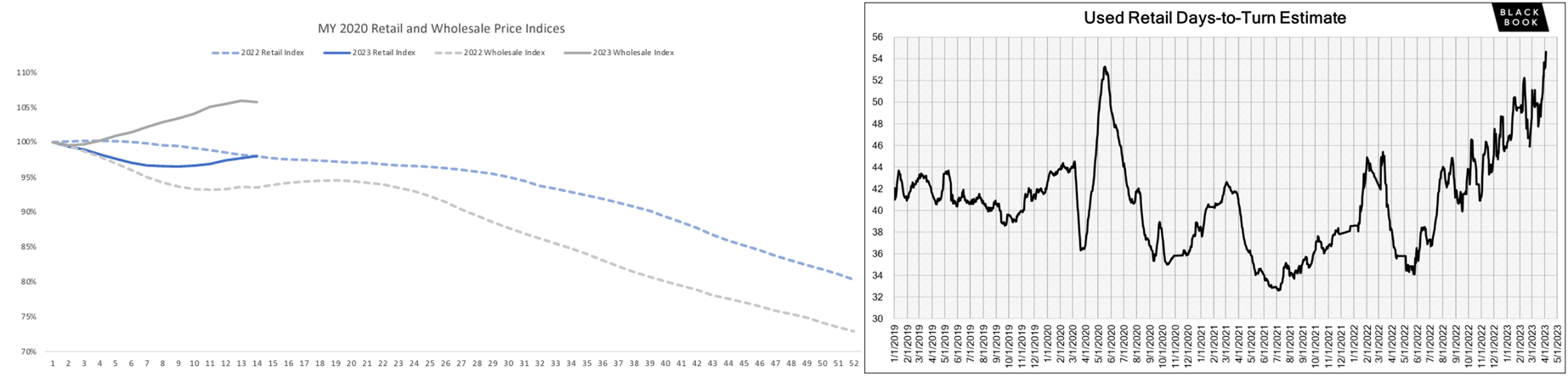

The tax narrative is unfortunate news to piggyback on declining consumer sentiment numbers in March. This information directly affects retail pricing. Expectations for consumer purchasing began hot in early 2023 but have cooled since, resulting in the stall of vehicle price increases. The graphic below (left) depicts retail and wholesale prices related to the average mid-year price in 2020. Though both distribution channels saw price increases in Q1, that trend may end.

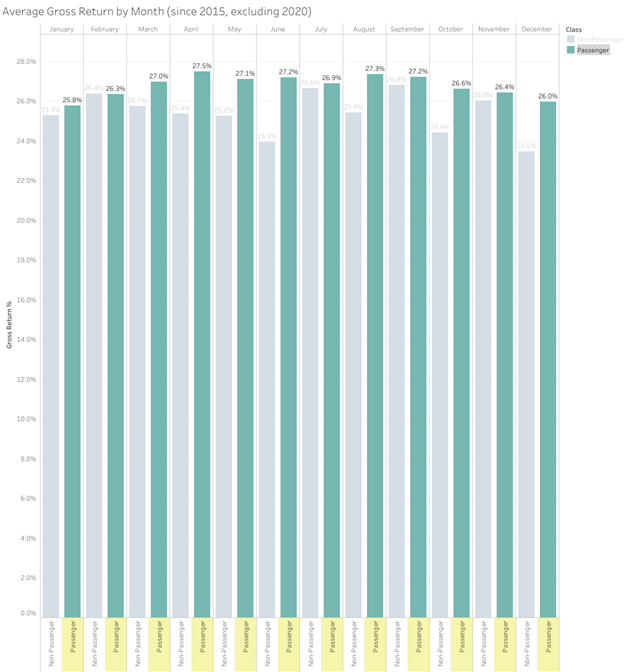

So what does that mean for salvage returns? Historically, April is one of the year’s highest gross return months for salvage. Since 2015 (excluding the events of 2020, when the market changed dramatically in April due to the financial uncertainty associated with the pandemic), April has been the highest gross return month all year for passenger vehicles (below). 2023 is shaping up to be no exception, but the positive increase from tax season will be slight. Following that, current market indicators suggest a retail pricing decrease is imminent — which has also historically meant declining salvage returns. So the end of this tax season is set up for disappointment twice over. Salvage auction prices naturally walk backward this time of year (following tax refund season). Still, a decrease in retail pricing suggests a sure return decline through August across the industry.

We’ll continue monitoring the decline rate to ensure salvage vehicle pricing aligns with market expectations. We should see an increase in initial auction bid rejections if and only if initial bidding declines faster than market value. That tends to happen frequently at the beginning of a directional change in salvage returns.

In the meantime, here is a summary of March return results:

4638 Total Vehicles Sold with a gross return of 25.5%

$1,642,252 in auction increases realized in addition to gross return (MAST factor) of 2.04%

An average gain of $756.80 per initially rejected bid and a success rate of 93.4%

$3,594,676 net return dollars (after MAST investment) realized YTD 2023.

Auction Management Wins of the Month

Successful auction management includes identifying when risk outweighs a potential reward.

This late-model GMC Sierra 3500 HD was involved in a devastating front-end collision, wiping any potential value in the engine compartment. Rather than focusing your research exclusively on comparable one-ton trucks with extensive front-end damage, it’s equally important to focus on the undamaged components. The flatbed of this truck is hauling three fuel tanks in perfect condition with a retail value starting near $1200 per tank. The initial auction came in near scrap value, indicating that full market value would only be achieved if the right vocational buyer was present. Following a second auction run, it was sold to the highest bidder. While the final sale was still below market research, it was a 173% increase from the initial bid. Two weeks of buyer activity proved that, in this case, the risk of waiting for a specific buyer needing mobile fuel tanks was a gamble not worth taking.

Auditing your salvage assets before being sold at auction will ensure maximized recovery.

A rear impact landed this 2021 Toyota Avalon in the auction yard. After the traditional exchange of hands from accident site, tow, storage yard to the auction vendor, this beauty arrived without keys. The buyer listing showed displayed this unit, rightfully so, as a non-start. Missing keys flagged this listing for review in the system. A quick cost-benefit analysis on the operational status of comparable rear-end damaged units indicated approximately a 10%, $4K difference in return. A replacement key was approved and cut for $360, and the buyer listing was updated from stationary to Run and Drive. Ultimately, this unit sold on the initial auction run for 61% of ACV, right in line with fair market value.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.