Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

March 2023

Happy Monday! I hope your week is off to a great start. If not… take a deep breath and try pressing Alt+F4 for a system restart.

The average salvage purchase price at auction steadily improved through February and has been up 5.7% since the last week of January. Salvage returns have continued to move positively as we move further into 2023. Retail vehicle pricing continues gaining steam (Manheim Used Vehicle Price index up 4.31%), seemingly indicating more good things regarding claim recovery dollars. Positivity overall!

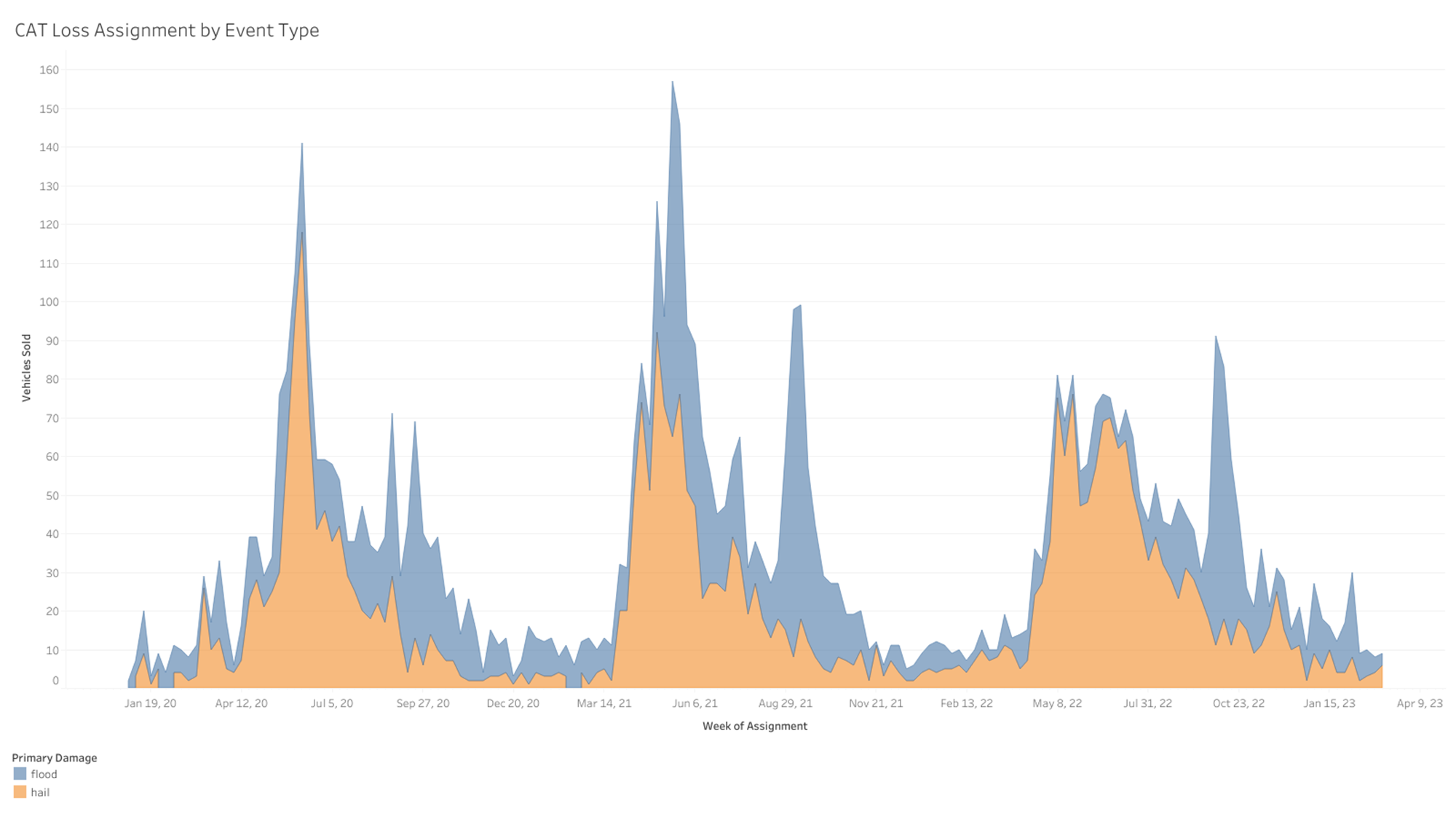

This helps me feel a little less bad about turning the subject into a sore subject: CAT claims. Unfortunately, it’s that time of year. We see a spike in hail and flood losses through the summer months, but as you all know, April has kicked the season off with an uptick in hail assignments the last three years consecutively (below).

As you prepare your teams for the upcoming season, you should pay particular attention to your early event claim-handling decisions. We all understand cycle time impacts salvage returns, but we’ve quantified that expense on catastrophe losses this month. When a large storm occurs, all providers within a localized region are affected. MAST provider numbers represent about 4% of the collective industry. Still, based on the last three years of auction data, there may likely be as many as 2300 additional catastrophe units assigned weekly in affected areas. That is an enormous volume increase in these markets. Even though some CAT units tend to see quality returns through auction, there is a definite race to get them listed and sold before the local market shows signs of satiation.

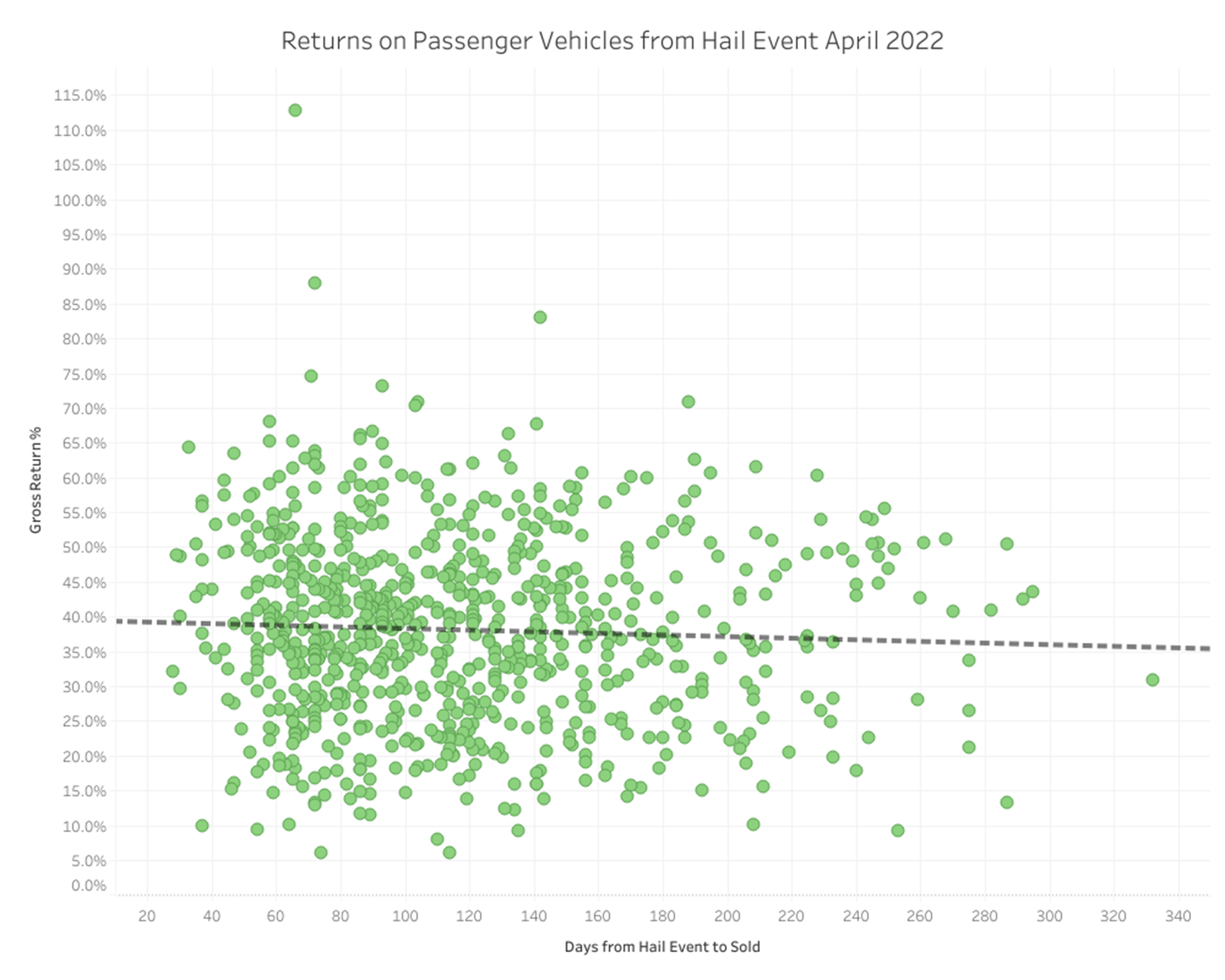

For example, see the data below from last year’s largest recent hail event in April. In the graphic, we compare gross return for passenger-class vehicles relative to the number of days that pass from the hail event to the final sale.

While the sample above includes all vehicle ages and passenger classes, there is a generally negative trend for gross return rate relative to the time needed to assign and sell a salvage asset at auction. At 30 days, the trend line suggests a return of 39.5%, but by the 120th day, the linear regression suggests only a 37% recovery rate. Considering the average claim settlement value (ACV) for last April’s event was $15,155, that is an expected average loss on recovery of $379 over that other three-month span ($5986 return at 30 days, $5607 return at 120 days)… or $4.21 loss on recovery per day!

We’ve assembled a CAT matrix to assist your people with early claim-handling decisions on hail-damaged and flooded units. This tool will help your field appraisers with expectations for salvage recovery as they complete estimates and, ideally, help your team spot potential total losses faster. This matrix is updated each spring and fall to reflect seasonal returns in the immediate months.

We hope your catastrophe losses are light this year, but we’ll certainly be prepared to support you on this and all inventory at auction next month. In the meantime, we will review all vehicles set for sale with near-term market expectations in mind. Here is a summary of February return results:

3,737 Total Vehicles Sold with a gross return of 25.4%

$1,452,375 in auction increases realized for an increase to gross (MAST factor) of 2.28%

Average gain of $830.88 per initial rejected bid and a success rate of 94.5%

$2,325,025 cumulative net return dollars (after MAST investment) realized YTD for 2023.

Auction Management Wins of the Month

Market trends forecast continued demand for LCV units through 2030. These units have historic appeal to a broad market but check out the forecast expectation in this class. ReportLink estimates the global LCV market will grow from $568B in 2022 to $640 Billion in 2023, reaching $1,001B by 2027. Post-pandemic consumer habits have greatly contributed to this. Fleet operations grew as online purchasing has gone up. Small business startups, delivery services, and freight companies are rising to satisfy post-pandemic buyer behavior. On top of that, recreational vehicle conversions from utility vans are pushing retail prices even higher. Amazon is not the only one driving utility vans anymore. Four years ago, cargo vans were never a 35% salvage recovery unit, but today you can count on it. Investing time in market research and consumer demand will identify undervalued auction bids. The initial run came in below fair market value. After negotiations, an additional $5,025 was added to the final settlement.

A targeted in-person review affords the ability to thoroughly assess the condition of high-value units while efficiently managing resources, including the time of your people. Predetermined inventory parameters can suggest units like this $55K Fifth Wheel as worthy of boots on the ground to conduct a detailed review. Often intangible data like the smell of a flooded camper can be very informative. Still, that information may not necessarily be worth the time and expense to confirm the condition after sitting in a salvage lot… in Louisiana… through the middle of summer. However, this unit was flagged in our database, and the in-person review was conducted. That assessment yielded $5K more than the initial auction, proving the windshield time was a worthy investment.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.