Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

December 2022

Happy Friday and Seasons Greetings!

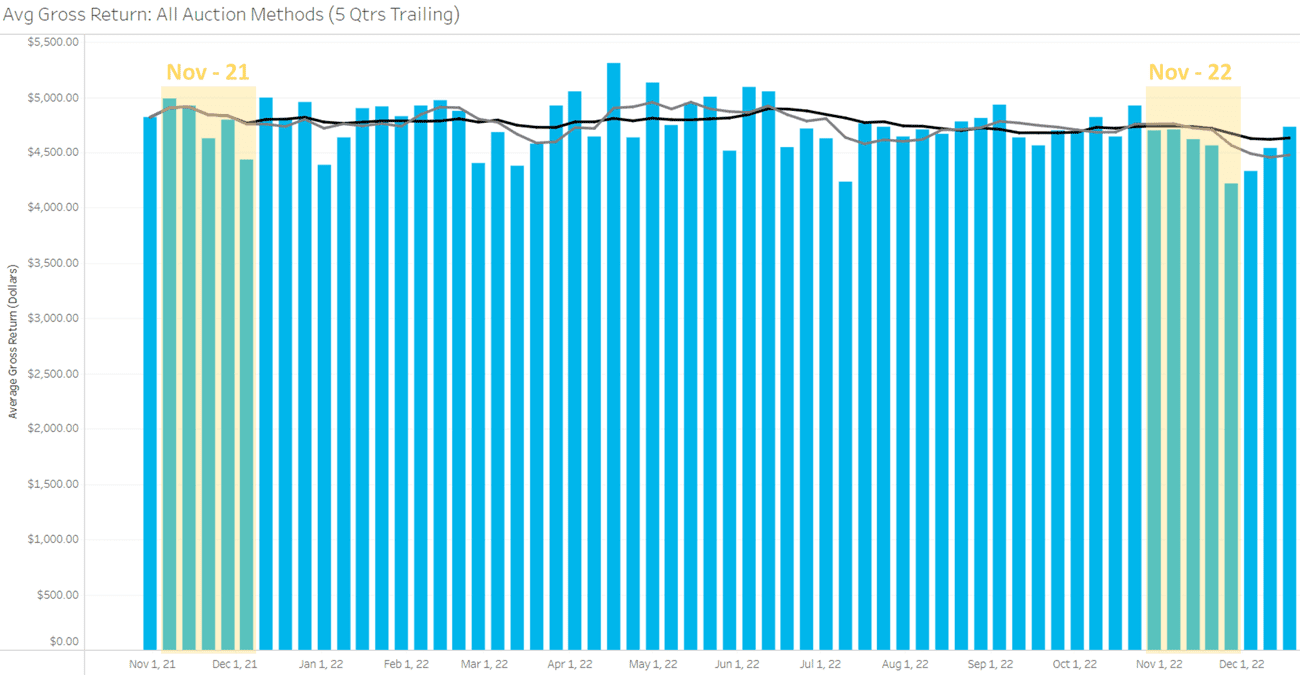

Salvage returns fell across the industry in November. The average purchase price of a vehicle at auction fell 8.0% from the first week of November ($4707.48) to the first week of December ($4330.93). A decline in auction returns is typical this time of year. Salvage auction purchase prices fell 11.1% across the industry during the same period in 2021 (below).

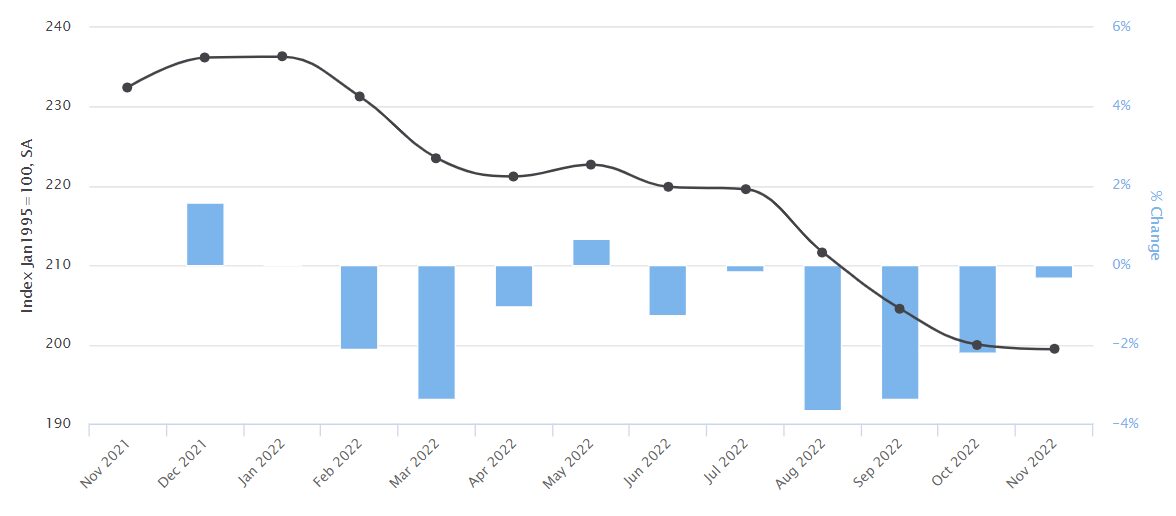

Following virtually no market movement in October, the 8% decline in salvage purchase prices through November seems unsurprising, especially as the wholesale market reached its lowest level in more than a year.

It’s worth noting, however, that the rate of decline in vehicle pricing has been slowing over the last few months. According to the Manheim Used Vehicle value index, November saw a 0.3% reduction in the index marking a sixth consecutive month of falling prices. Still, that rate of change has declined consistently since August (below). Continuing this trend suggests we are nearing the floor of the retail pricing decline. Early December numbers suggest that savvy buyers have already begun spending more at salvage auctions in anticipation of the end of the vehicle price decline with hopes of a rebound for rebuilt salvage vehicles in early 2023. Auction purchase prices are up 9.2% through the first two weeks of December.

While we increased our initial bid rejection activity dramatically in November (51.1% industry-wide) as salvage auction results took a sharp dive for 30 days, we anticipate a quick re-list and sale of those affected units as this decrease appears to be short-lived. We continue to be encouraged by our team’s analysis across all vehicle classes as the rerun success remained very high at 92.3% for an average increase of $805.84 per initial bid rejection decision industry-wide, despite an elevated rerun rate. As long as our success rate remains high for auction decision-making, we will continue to presume we are interpreting buyer interest accurately and should be able to continue to produce significant auction lift on your salvage results.

In the meantime, here is a summary of November return results:

3,666 Total Vehicles Sold with a gross return of 25.1%

$1,508,525 in auction increases realized for an increase to gross (MAST factor) of 2.27%

Average gain of $805.84 per initial rejected bid and a success rate of 92.3%

$12,779,109 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

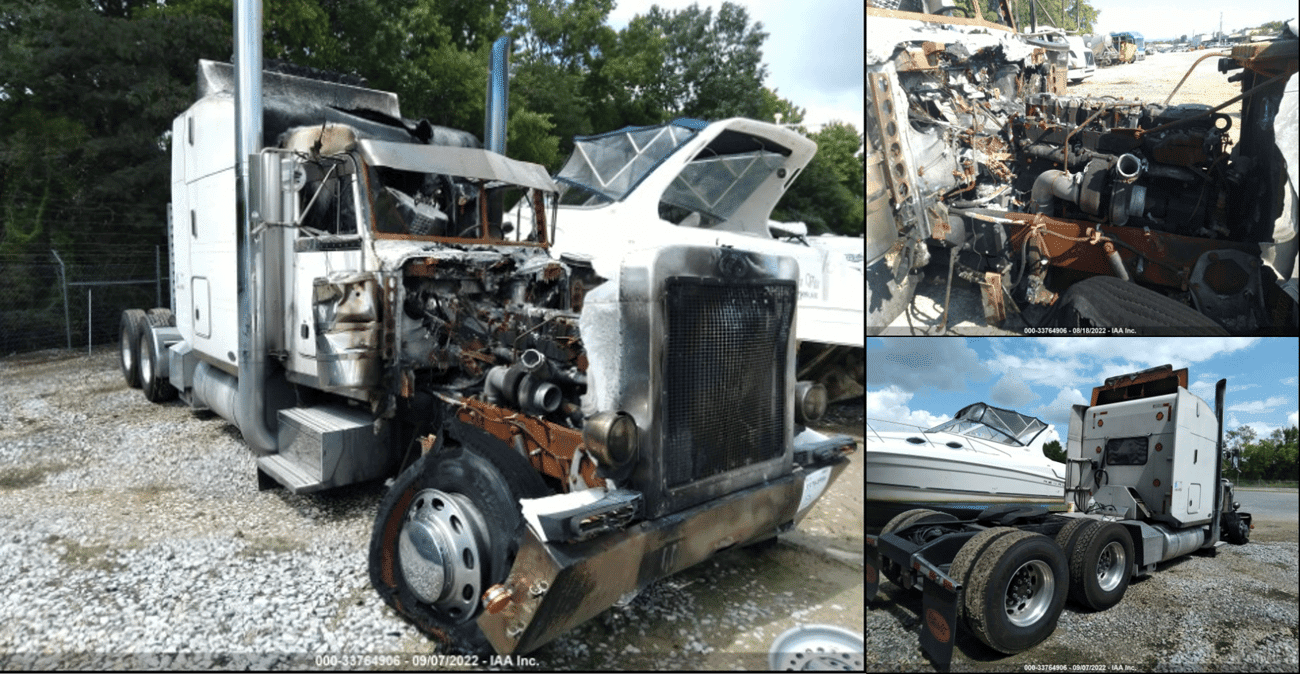

Salvage expectations shouldn’t go up in smoke just because the loss did.

Specialty units and commercial transports like this can be challenging to evaluate a salvage value accurately. Standard vendor tools that generate rapid salvage valuations based on comparable loss types were not designed for detailed segmentation, making it extremely difficult to recall true ‘like-kind’ comparisons for research purposes. Applying the same search techniques to a detailed VIN decode and vehicle classification system will enhance your ability to assess salvage value as you’re conducting a break-even decision or, like in this case, identifying when an initial bid offered is below fair market. This 1999 Peterbilt was a total burn and sold on a parts-only title, it’s clearly inoperable. However, the fire was contained in the engine compartment leaving the sleeper cap and rear axels untouched. The remaining value was apparent, and the decision to reject the initial bid was a quick one. It sold the next day, bringing the provider a 24.4% increase in the final sale.

The holiday season is here, and buyers are shopping for rebuildable toys for their workshop.

There are two key ingredients to ensure a fair market return on your salvage at auction. First, an initial review to set expectations should be determined from similar units sold in a recent market cycle. Immediately following your comparison research, it is imperative to incorporate a current market analysis to identify any recent fluctuation and account for it when finalizing a salvage expectation and setting the reserve. Although returns for 2022 have followed a more predictable trendline for our industry, short-cycle analysis identified spikes in buyer activity in July and again in Sept, remaining elevated through the early weeks of November. This type of dual review avoids setting undervalued expectations. On auction day, this 2021 Polaris Razor brought an initial high bid of 42%, a realistic return in a traditional market. But the post-pandemic market has been anything but traditional. A second run brought 51.6%, a significant improvement but still shy of current market expectations. A final sale was negotiated at 55.4% of ACV on that same day.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.