Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

November 2022

Happy Monday. Hope this week is off to a great start for you.

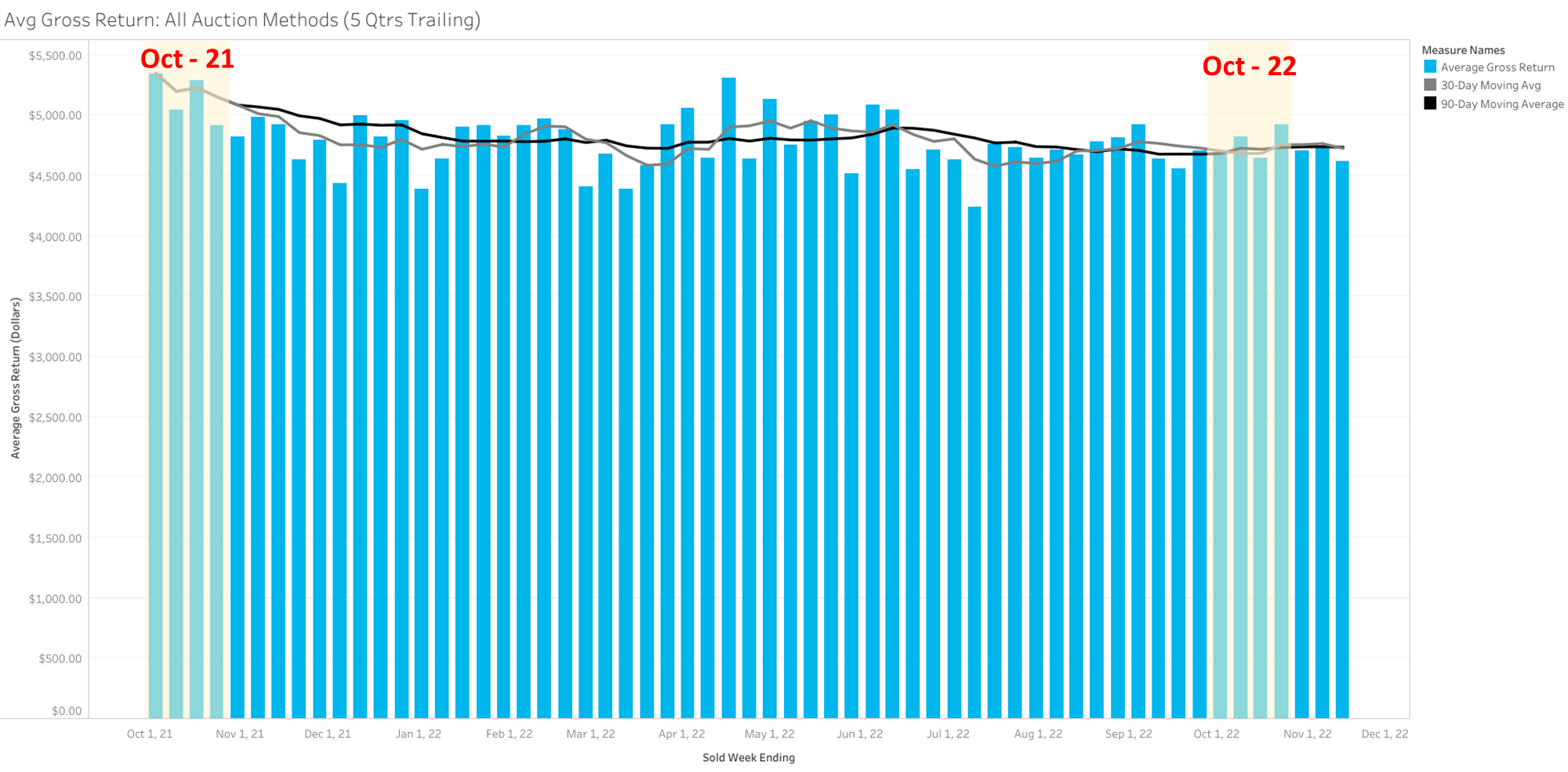

Salvage return results were stable in October across the industry. The average auction purchase price of a salvage vehicle at auction remained nearly unchanged (0.27% increase) from the first week of October ($4690.90) to the first week of November ($4703.99). While this has been a consistent 30-day period, this is a radically different trend for the beginning of Q4 relative to prior years — including last year when average auction purchase prices fell 9.9% through October 2021 (below).

This is important for two reasons.

The first reason is something we’ve discussed in previous monthly reports, but it is worth revisiting. Little or no change in auction results alongside declining claim settlement values can appear to improve auction return % artificially. Even though auction purchase prices were unchanged through October, the retail price of used vehicles has been falling across the industry. And while this means claim settlement values (ACV) are subsiding (which is positive news for claim resolution), if you are measuring your salvage results in terms of percent of ACV recovery (gross return %), you may see an artificial positive trend. Gross returns have only increased when either auction purchase prices have risen and the claim settlement amount remains unchanged or when gross return increases outpace claim settlement increases.

On the whole, across the industry, neither occurred in October. Purchase prices have remained static while used retail prices continued to fall. It is worth noting, however, that used vehicle prices are starting to fall a bit slower than in prior months. According to the Manheim Used Vehicle Value Index, October saw pricing fall 2.2%, which is less sharp a decline than September (3.36%) or August (3.64%). Stability in used retail pricing means predictability in future resale value for prospective salvage buyers. Three consecutive months of narrowing price reductions could suggest we are nearing the floor of falling prices. Because auction purchase prices are neither increasing nor decreasing, our expectations for near-term auction results remain unchanged.

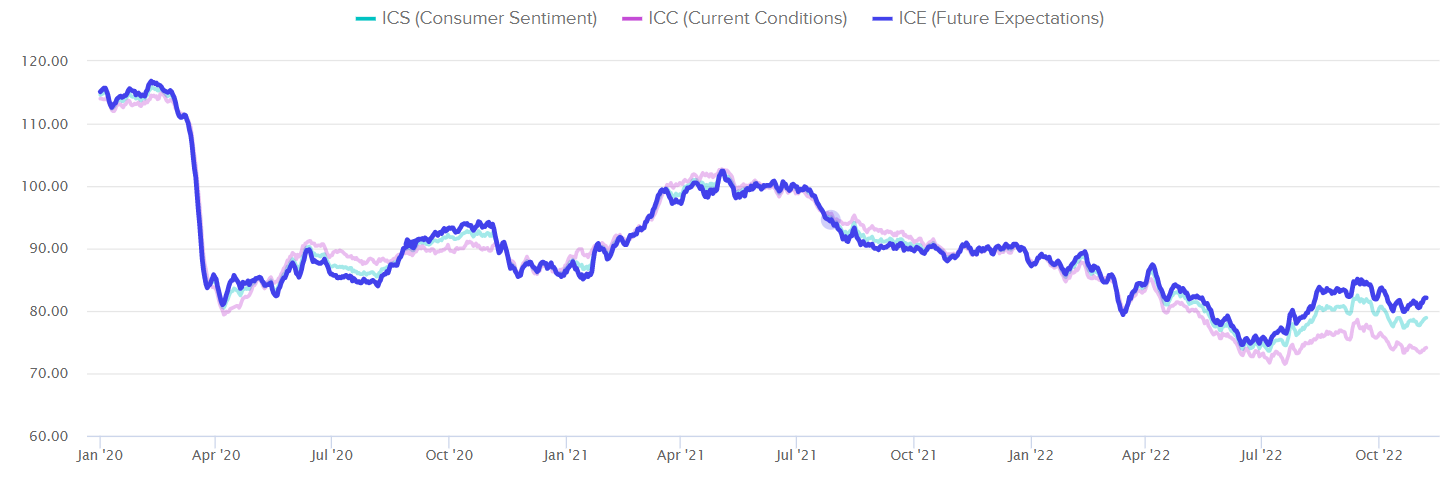

The second reason an uncharacteristically stable October is important is that it seems to suggest salvage buyer confidence in the market remains strong, despite falling retail prices and declining consumer sentiment across the country. It’s no secret that economic concerns fueled by impressions of rising inflation have negatively impacted consumer sentiment in 2022. Despite substantially low perceptions of the economy, a US Consumer Confidence poll suggests that future expectations have continually improved since July of 2022 (below). In fact, according to Manheim’s October Used Vehicle Value Index report, even though the present situation is dire for many consumers, the likelihood of near-term improvement seems certain to many, and “plans to purchase a vehicle in the next six months rebounded strongly to the highest level since July 2020 and was up substantially year over year.” This kind of leading indicator signals to salvage buyers intent on rebuilding that there will be a strong demand for consumer vehicle purchases in the months to follow. As a result, auction purchase prices in October and presumably November will continue to remain elevated. In previous years auction bidding has subsided through Q4 months. So far in 2022, we have not seen that happen, nor are there any strong indicators that bid activity at auction is slowing.

We have been encouraged by auction purchase activity across vehicle classes in October and will continue to review all vehicles set for sale while holding an elevated but reasonable floor for auction expectations. This will likely mean a continued increase in rejections of initial auction results and negotiation activity from our Analyst team. As long as our success rate remains high for auction decision-making, we will continue to presume we are interpreting buyer interest accurately and should be able to continue to produce significant auction lift on your salvage results.

In the meantime, here is a summary of October return results:

3,563 Total Vehicles Sold with a gross return of 25.76%

$1,486,050 in auction increases realized for an increase to gross (MAST factor) of 2.24%

Average gain of $899.55 per initial rejected bid and a success rate of 92.6%

$11,607,268 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Calculated expectations in advance of a storm maintain efficiencies during a CAT response.

Storm season brings unique challenges to any claims team. Quick resolution is likely at the top of the stacked list of priorities. Customers are displaced, and volume piles up quickly. What is not as unique is the loss type following mother nature’s wrath. Depending on the region, storms typically bring hail, flooding, or both. Segmenting inventory by vehicle class, production year, and loss type compared to recent sale cycles accurately predicts a fair market salvage return and sets your adjusters for rapid review without sacrificing accuracy. This 11-year-old travel trailer was a total loss for water damage. The CAT Matrix indicated 32% as a realistic expectation. When the initial run only brought 21.4%, it was a quick rejection decision. It sold for 33% of ACV the following day, or a $1,850 increase to the final sale price. Advanced expectations, in this case, assisted an accurate total loss decision up front followed by a fair settlement through the auction.

“The difference between something good and something great is attention to detail.” -C. Swindoll

Trucks are not one size fits all. More than any other passenger vehicle class, it’s imperative to have a clear understanding of your unit prior to auction day. An accurate VIN decode will tell you what your unit is equipped with. This 2020 F-250 has 4-wheel drive and a 6.7L diesel engine. But unless the system you’re pulling comps from records specific information direct from the VIN decode it is nearly impossible to sift out comparable units with those exact specs. With minimal damage, all straightforward body repairs, there is no doubt the buyers did their homework on this one. The initial high bid brought 44.8% of the ACV, nothing to shy away from. However, in today’s limited supply market, an easy rebuild, late model, highly popular truck is going to bring the money. Both the buyer and the seller knew that initial bid was light. A successful negotiation landed with that same buyer $8,150 north of their initial offer and a final sale at 55% of ACV back to the provider.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.