Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

January 2023

Happy Monday. I hope the new year is treating you well.

In December, vehicle retail pricing began slowly increasing, but salvage returns were down again. The average salvage purchase price at auction fell 0.3% from the first week of December ($4333.05) to the first week of January ($4319.63) industry-wide. December capped a year-long 1.6% decrease in salvage value from 2021 to 2022, but the 0.3% decrease in December was better following an 8% reduction the month prior. The slowed decline in salvage recovery from November to December is likely related to the beginnings of a rebound in used retail pricing, as evidenced by a 0.8% increase in the Manheim Used Vehicle Value index. Retail prices have consistently fallen since May.

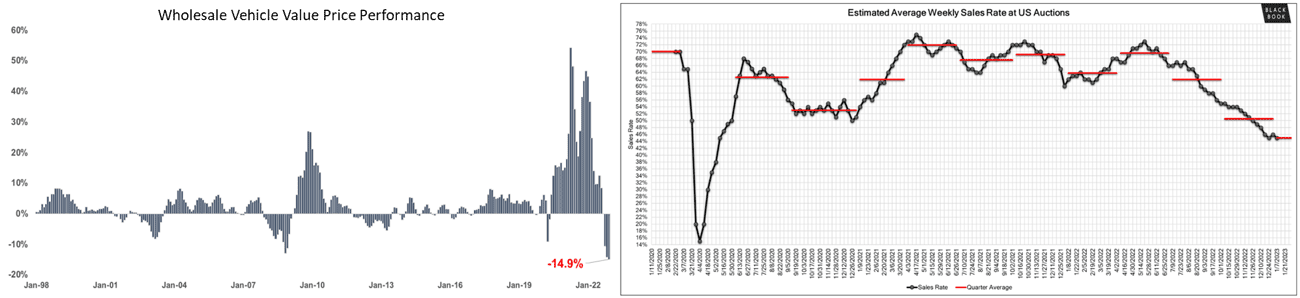

Interestingly, wholesale pricing saw a 14.9% decrease in the last 30 days (below left). According to Cox Automotive, the wholesale pricing decline this past December was the largest in history. That’s right — history. Wholesale auctions reflect wholesale pricing and supply independent dealers with vehicles to sell directly to consumers in the retail market. Wholesale suppliers approve vehicle sales through wholesale auctions like MAST manages the salvage auction. When wholesale bids are inconsistent with market value, no sale occurs. Lately, independent dealers (buyers at wholesale auctions) have been extra cautious about purchasing too much inventory with recent uncertainty in the retail market. Some retailers, like Carmax, have purchased far fewer wholesale units recently as pricing declines in 2022 create staggering depreciation rates on the vehicles they have previously procured. From their perspective, high-interest rates make it challenging for consumers to purchase a car with an affordable monthly payment, and varying consumer sentiment has led to less predictable buying behaviors. As a result, sales through wholesale auctions have collapsed to the 40 percent range (below right).

Why does this matter?

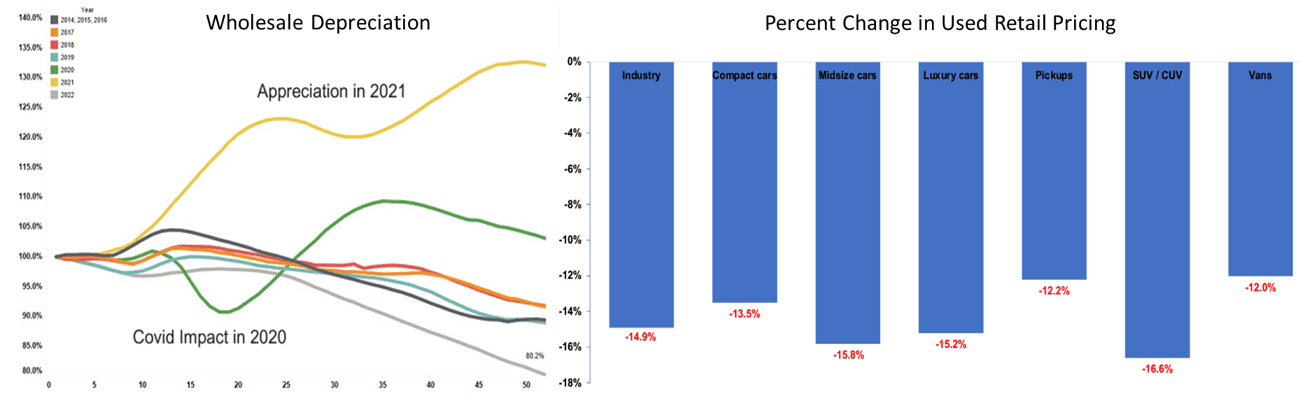

Few confirmed wholesale auction sales directly impact the volume of new retail vehicles available to consumers. Independent dealers (the largest segment of salvage buyers) recently struggled to move their current inventory at preferable margins, resulting in increased sensitivity to specific makes and models. Dealers incur depreciation the same as individual consumers. The faster they turn a unit, the less the impact. In 2021, dealers caught an unprecedented break as the inventory they procured appreciated as prices continually rose. However, the high cost of vehicle acquisition became problematic when vehicle prices began falling in June of 2022 (bottom left). Depreciation continued through the second half of 2022 but was inconsistent across vehicle classes (bottom right).

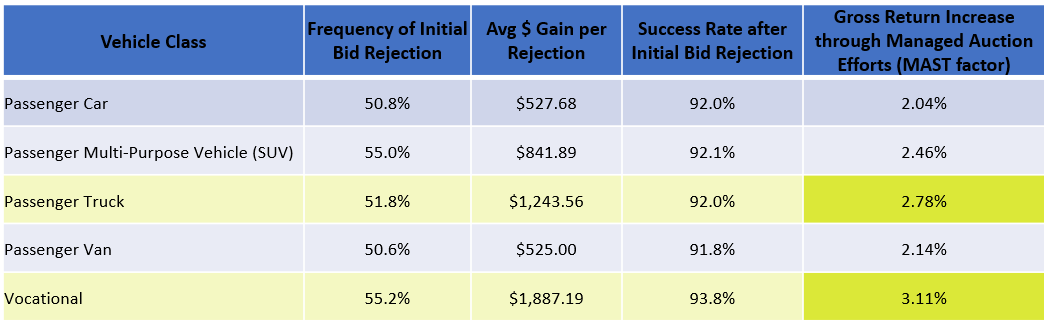

Economy class, pick-ups, and work-related vehicles fared the best in 2022 compared to the overall industry. These vehicle classes have shown more auction lift opportunities in Q4 of 2022 (below). Lower depreciation rates in these classes suggest larger margins for vehicle purchase and tolerance of negotiations and BuyNow sales following initial runs. Vehicle providers with higher counts of these units in their inventory have seen less decline in their salvage results.

We have been encouraged by auction purchase activity across vehicle classes in December. We will continue to review all vehicles set for sale while holding an elevated but reasonable floor for auction expectations. These expectations may mean a continued increase in rejections of initial auction results and negotiation activity from our Analyst team until auction results rebound. As long as our success rate remains high for auction decision-making, we will continue to presume we are interpreting buyer interest accurately and should be able to continue to produce significant auction lift on your salvage results.

In the meantime, here is a summary of December return results:

3,959 Total Vehicles Sold with a gross return of 24.8%

$1,744,015 in auction increases realized for an increase to gross (MAST factor) of 2.46%

Average gain of $802.95 per initial rejected bid and a success rate of 91.9%

$14,171,098 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Prioritizing a detailed, car-side review will maximize your salvage recovery expectations.

This 2016 Toyota Tundra is an excellent example of the importance of segmenting your salvage and prioritizing when it makes sense to get boots on the ground. Totaled out for engine burn, an onsite review of this unit was scheduled because the posted pictures were difficult to determine damage severity and how that might impact buyer interest. Relying solely on standard vendor tools indicates a fair expectation for an engine burn on a full-sized truck, yields approximately a 15% return on ACV. The initial run-through auction brought 26.7%, which is reasonably strong. Or is it? A detailed review of the unit in person compared to the current market performance for this class confirmed this unit was well above average. Expectations were set closer to 45%. Following the initial bid rejection, this unit sold the next day to an online bidder for 43.2% of ACV.

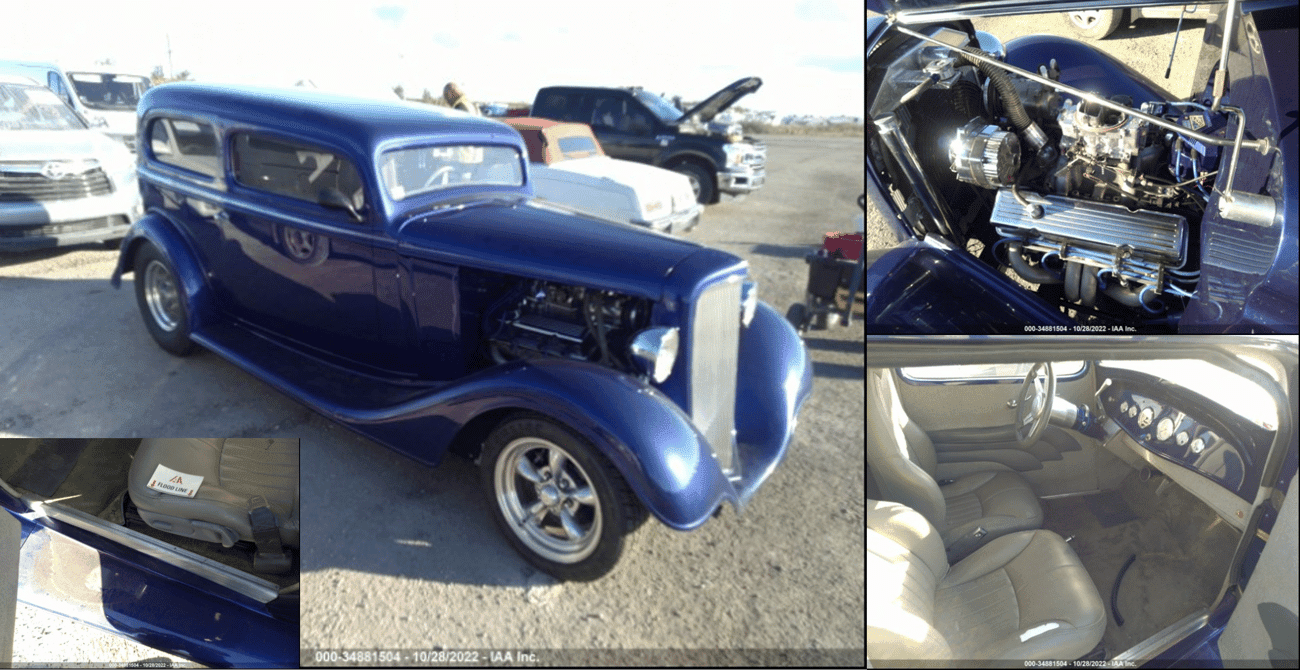

A robust database designed to cross-reference similar makes and models is crucial to accuracy.

This 1934 Chevrolet 2-door Coupe was maintained in pristine condition. Sadly, it fell victim to the floods on the east coast in Q4 and was totaled for extensive water damage. Rare units like this are difficult, if not impossible, to identify a direct comparison to predict future salvage return expectations. More inclusive search parameters that populate comparable makes and models present the opportunity to review similar salvage sold even in a rare class or a unique loss type. Employing this type of reserve assessment in advance of the initial auction flagged a low initial auction bid. The following week, a negotiated sale was achieved with a new high bidder for a 22.8% increase, directly in line with pre-set expectations.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.