Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

October 2022

Happy fall y’all. October always seems to offer a few delights and frights. I hope this month brings you more of one than the other.

While the third quarter was initially mostly uneventful, September indeed flipped the script. Hurricane Ian rocked the Southeast, while the Midwest saw major hail events across the region. As your people respond to these events, we highly encourage them to utilize our 2022 CAT matrix to assist with salvage expectations in the field.

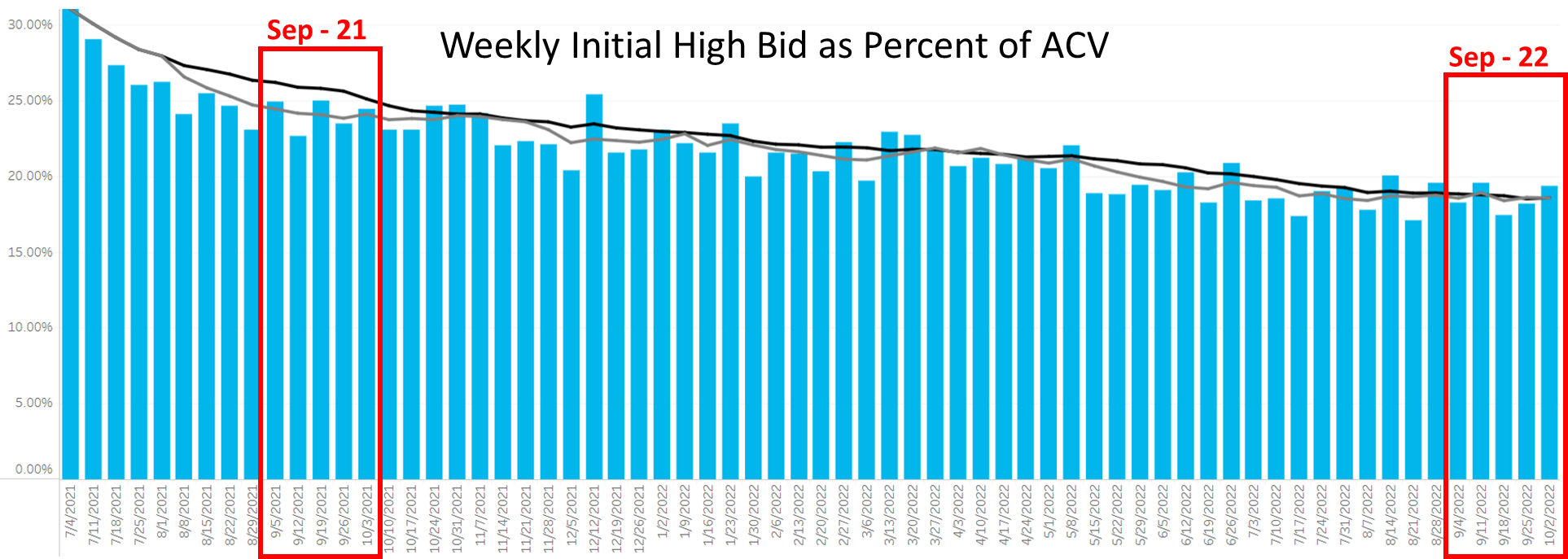

The uptick in storm losses will impact salvage returns in coming months, but at present, auction results remained surprisingly even across the industry throughout September — except for the first week of the month. Average initial high bids offered at auction measured 18.23% of ACV in the first week of September, while initial high bids measured 18.22% in the last week of September. This same period the previous year saw high bid activity fall 1.47% (below).

Salvage buyers are being fairly conservative with the auction offers (neither increasing nor decreasing) as they attempt to digest what the retail market will be doing 60-90 days from now. They are caught in the middle of mixed signals from the retail and wholesale sides of the industry.

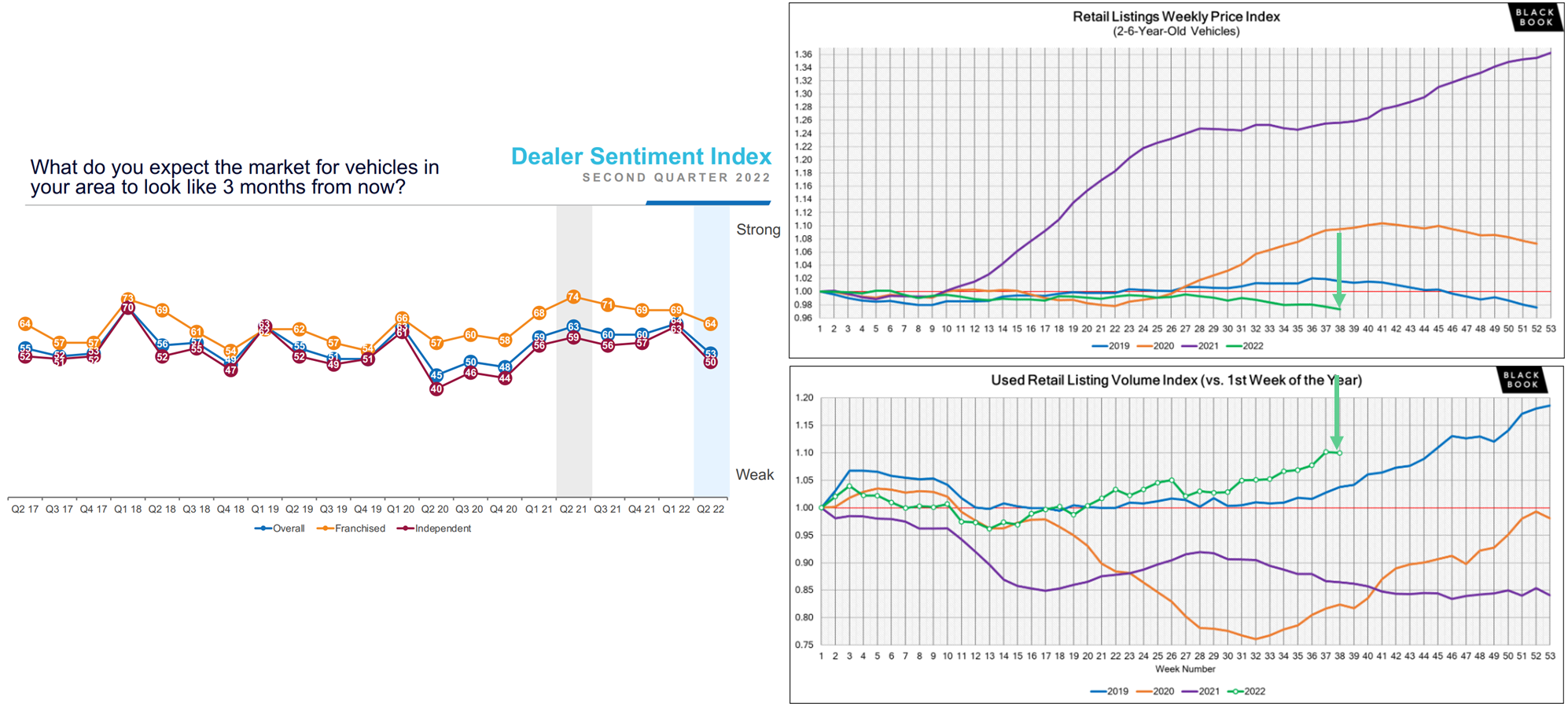

On the one hand, dealer sentiment has waned dramatically. While most dealers were initially optimistic about the outlook of vehicle demand in Q1 for the immediate months to follow, by Q2, that sentiment had fallen significantly (below left, Cox Automotive). And to be fair, that decline in outlook is very justified. Although used vehicle retail prices have dropped considerably throughout the year, the volume of available inventory isn’t moving (below right, BlackBook Market insights). Used vehicle retail prices will continue to fall until inventory levels stabilize.

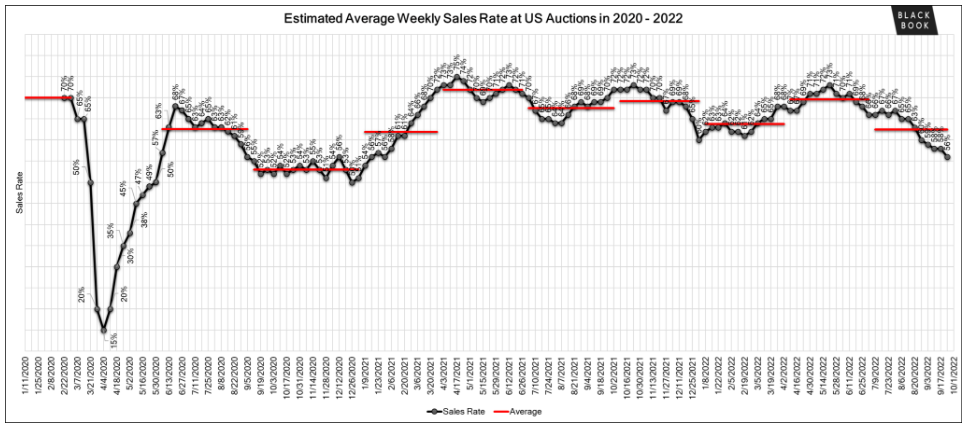

On the other hand, wholesale suppliers are signaling (or perhaps hoping for) a retail market turnaround. The graphic below depicts the willingness of wholesale suppliers to sell through the wholesale auction weekly. Through September, less than 60% of vehicles were approved for sale through wholesale auctions. This is the marketplace where large independent dealers, fleet companies, and rental car agencies procure their vehicles. Approval rates for the wholesale auction have not been this low since Q4 of 2020. Wholesale suppliers cannot hold out indefinitely, but they can stay low for an extended period. Approval rates remained approximately 50% for nearly four months in late 2020/early 2021. Depleting the market supply of wholesale vehicles for an extended period can influence market pricing — which is the desired impact wholesale suppliers are hoping for. Still, it can have another impact as well. Wholesale buyers may be forced to shop elsewhere (which is precisely what happened during the 2020/2021 time as rental agencies and independent dealerships began purchasing salvage vehicles at salvage auctions, creating more competition in that market).

October is late in the year for salvage auction returns to begin receding. Consumer sentiment was not what retail suppliers would have hoped for in Q3, but the wholesale and salvage markets seem to suggest that demand is still coming. There is good trending evidence to indicate that if salvage returns dip in Q4, they won’t dip far, and they won’t dip for long. Our auction management efforts, as of late, are operating along with those expectations. The initial high bid rejection rate remained very high over the last 30 days at 51.3% industry-wide. This is aligned with the actions in wholesale auctions and its current rate of accepted weekly sales (only 56% in the week ending 9/24). And while those numbers are high, the salvage market acknowledges that rationale as the success rate of those initial high bid rejection decisions also remained very high at 91.7% industry-wide.

We’ll continue to monitor auction results diligently. In the meantime, here is a summary of the auction return results for September:

3,693 Total Vehicles Sold with a gross return of 26.6%

$1,691,800 in auction increases realized for an increase to gross (MAST factor) of 2.63%

Average gain of $892.30 per initial rejected bid and a success rate of 91.7%

$13,452,690 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Tailored analytics in the commercial vehicle class decrease the margin of error on expectations. It is important to recognize the specifications as you target comparable salvage. This transport semi also has a sleeper cab, undoubtedly increasing the overall value. In the case of this 2015 Freightliner Cascadia 125, those metrics meant an extra $1925 in salvage recovery dollars. The initial auction bidding stopped short at $7,075. Identifying direct comparisons positions your team for more accurate impressions of value. This unit was flagged for underperformance and reposted, where it sold to an online bidder the very next day for the full asking price of $9,000. That’s slightly above our historical auction average of $1,277 per auction lift for all commercial transport units observed and managed through auction in the last 12 months.

Accurate salvage valuations bring confidence when engaging with experienced buyers at auction. Every salvage buyer at auction is incredibly informed and disciplined with the bids they offer. Most approach sale day with an inventory list and an anticipated range they are willing to spend. Their goal is obviously to spend as little as possible. In the last 13 years, we’ve captured auction performance data that suggests they accomplish this goal about 30% of the time. A successful sale starts with being as disciplined as these salvage buyers. This 2021 GMC Sierra SLT illustrates the buyer’s philosophy well. An auction return expectation was placed at $26,300. At the initial run through auction, bidding stopped at $19,250. This was well below market value but, more importantly, received very little bidding interest from competing buyers. A negotiation was attempted at our reserve of $26,300, but the buyer didn’t bite, nor did we lower our reserve off of fair market. However, a few days later, a second buyer elected to purchase this truck for the full $26,300 from an online listing. There was a 3 day cycle time delay, but the $7,050 recovery increase from where it started to where it ended justified the time.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.