Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

September 2022

Happy Friday, everyone. I hope the fall season is off to a nice start for you.

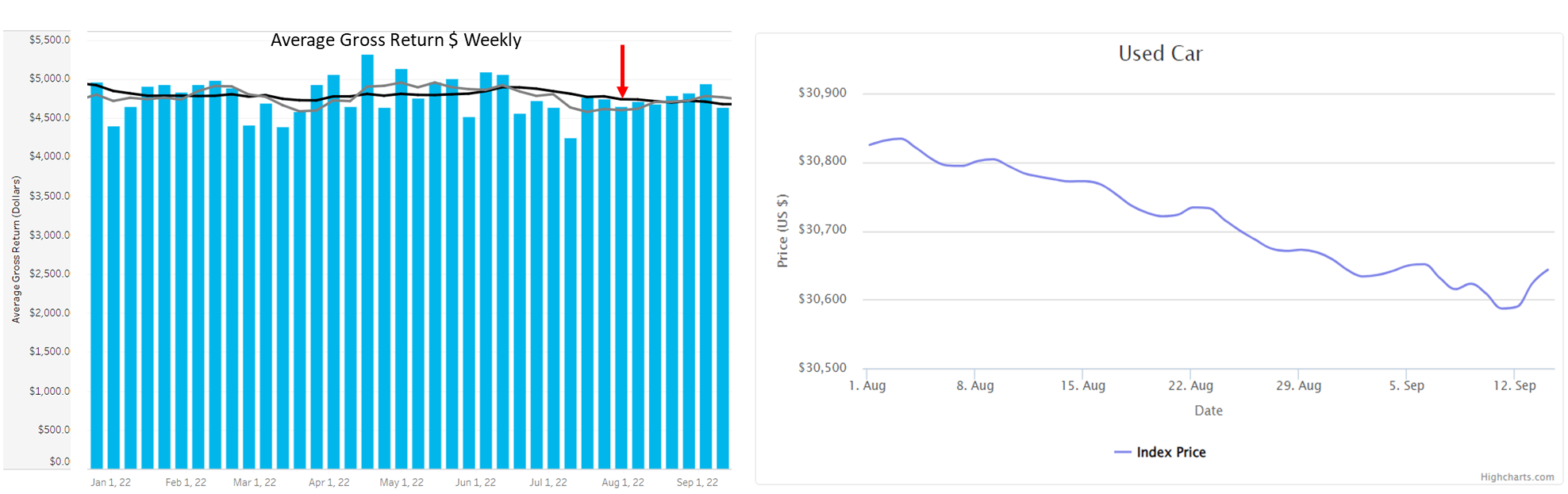

August was an encouraging month for salvage returns and claim handling. Average auction purchase prices increased weekly for the month through August and into early September (bottom left). Industry-wide, we saw a 6.2% increase in weekly gross return dollars from the last week of July ($4642.05) to the first week of September ($4929.51). Meanwhile, according to CarGurus price trends, the average used retail vehicle price declined 0.6% during that period.

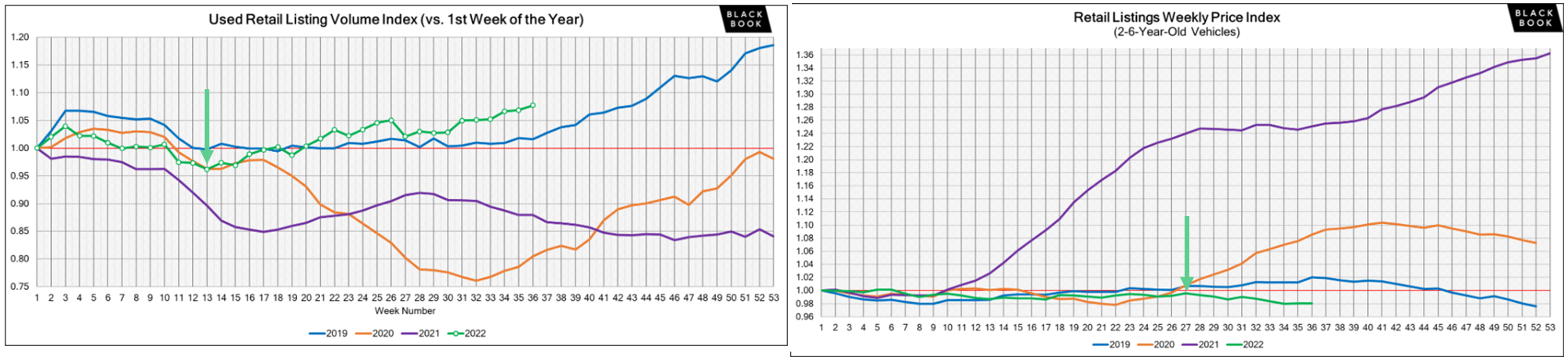

Rising auction purchase prices and falling retail market prices (claim settlement ACV) translate to a rise in % gross return. Providers around the country experienced that in August and will likely experience the same in September — which was a big reason for our bold prediction last month. But historically, this phenomenon is odd and likely won’t continue for a prolonged time. The only reason salvage prices and retail pricing are moving in opposite directions is that a retail pricing adjustment is long overdue. The volume of available used vehicle inventory has been increasing since week 13 of this year (early April, bottom left), while retail pricing did adjust until nearly three months later.

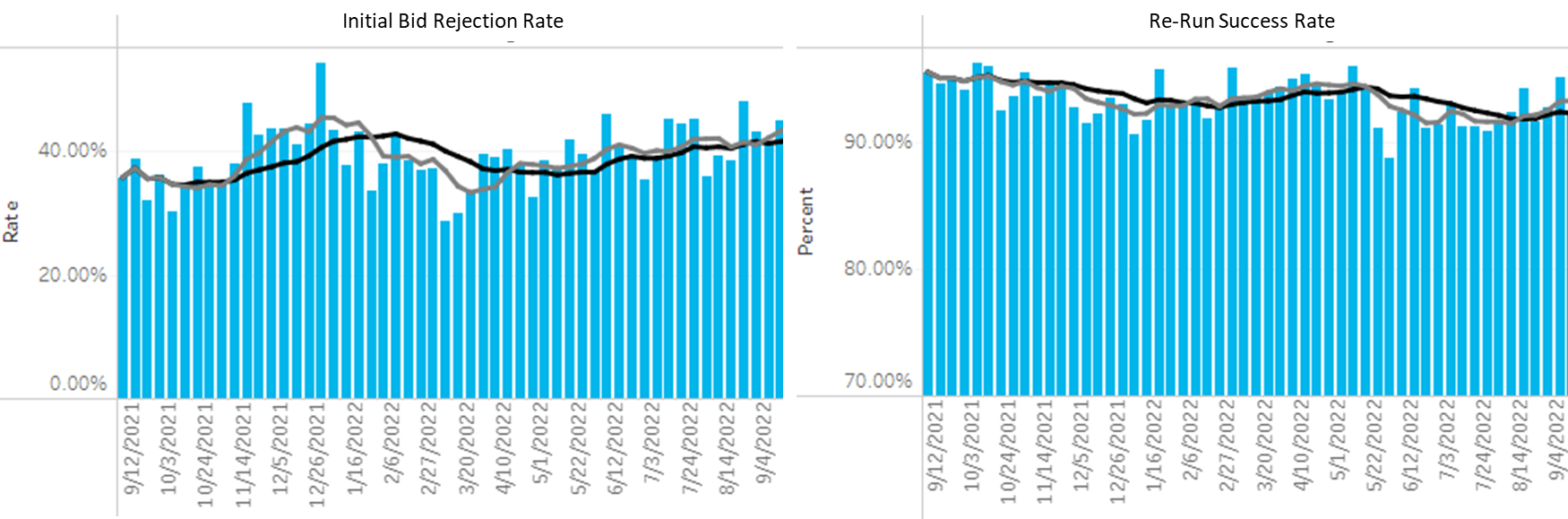

Because we closely monitor auction purchase behavior, we did not reduce our expectation for auction outcome (average reserve) despite falling retail prices. In fact, through August, we increased the initial auction high bid rejections through August (47.7% industry-wide in August, bottom left) while maintaining a high success rate with those initial auction rejection decisions (93.0% industry-wide in August, bottom right). A high frequency of initial auction high bid rejections combined with a high success rate of correctly identified auction results to improve meant August saw large auction impact numbers from our Analyst team, amounting to a net realized increase of $315.04 for every individual vehicle sold through auction in the last 30 day period.

September should see a continued decline in retail vehicle pricing as available vehicle volume remains elevated across used car lots. Auction purchase prices or Gross return $ may flatten but should not substantially decline (at least not until the midpoint of Q4). As a result, claim settlement recovery (gross return %) should continue to increase this month.

For most insurers, September also means an uptick in claim volume for recreational vehicles and Agricultural units as the recreation season is ending and harvest season is in full swing. Both types of equipment have seen elevated return rates in 2022 relative to years past. Please continue to send requests for salvage quotes to [email protected] for an accurate assessment of an auction expectation to assist your claim handling.

In the meantime, here is a summary for the month of August:

4,074 Total Vehicles Sold with a gross return of 27.5%

$1,650,073 in auction increases realized for an increase to gross (MAST factor) of 2.32%

Average gain of $849.24 per initial rejected bid and a success rate of 93.0%

$9,114,864 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Vehicle segmentation that includes similar classes widens the body of comps. Collision claims like this 2001 New Holland Tractor are not uncommon towards the end of harvest season. Yet, it is difficult to identify and comparable units to establish an accurate salvage expectation. Expanding search parameters to include similar makes and models often produce multiple salvage returns sold in the recent market cycle to review against your asset. Research indicated a fair expectation of value on this unit in its current condition was $9,000. With confidence, this tractor was sold to the high bidder after the initial auction run for $8,575. A 5% variance from the pre-set auction reserve.

Avoid being the ‘Discount Salvage Seller’ with accurate research and pre-set auction expectations. With summer coming to a close, the total loss claims on your rec units are likely making their way through auction. As inventory increases, salvage buyers are looking for deals o rebuildable candidates like this 2021 Honda CBR600RR. With a solid auction management process that centers on proactive inventory review, short-cycle market trends, and accurate valuations, you can identify a light auction bid efficiently and produce a lift that means measurable salvage recovery improvement for your team. An initial run through auction saw a final high bid of $975. Not consistent with pre-auction research and current market trends. A quick acceptance on a counter of $2,700, it was clear the buyer knew the initial bid was below fair market value as well.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.