Auto Salvage Monthly:

Market Trends and Drivers Behind Purchasing Behavior

July 2022

Happy Tuesday, everyone. With June at an end, we are officially halfway through the year. This month we have an update on industry trends we discussed at the end of Q1.

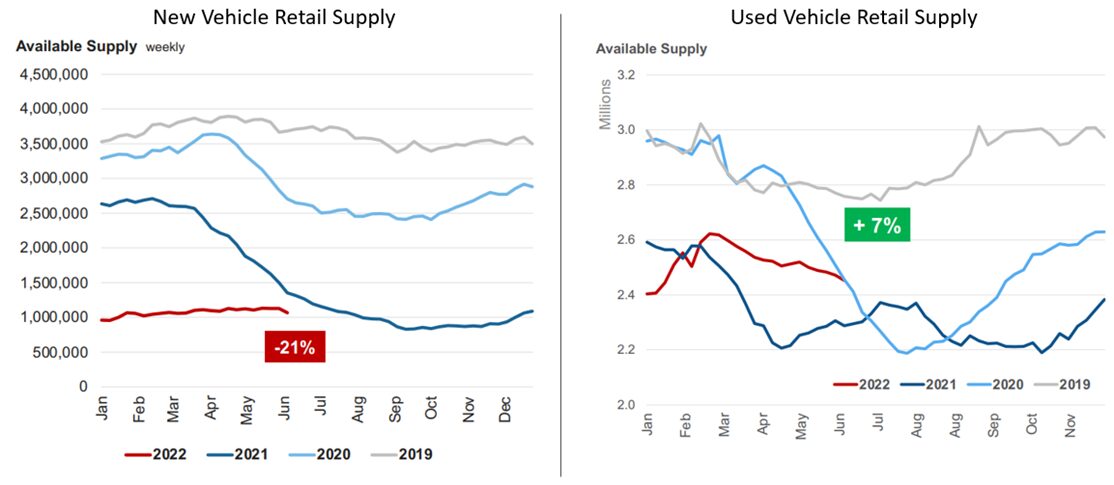

First off, available vehicle inventory is recovering slowly – very slowly. New retail vehicle volume has only seen minor improvement since January. According to the latest Cox Automotive mid-year report, the new weekly retail volume has crept from just below 1M units available weekly to just above 1M at the end of June (bottom left). That figure is 280,000 less than in 2021, improved, but still 1.6 million lower than June 2020. New dealer lot restock continues to be hindered by chip shortages and limitations in raw material supply. Used retail volume, however, is up 7% relative to last year (bottom right). This is a bit better than where we were 90 days ago when new inventory was down 59% and used retail volume had only improved 5% year over year.

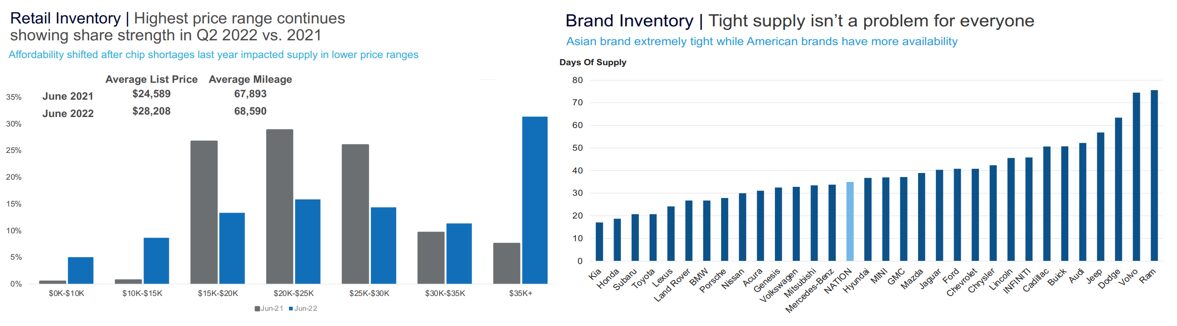

Secondly, while inventory remains depleted overall, the availability rate across pricing segments is inconsistent. Limited vehicle volume — particularly among more affordable vehicle classes — has created disproportionate availability. This phenomenon began when chip shortages affected vehicle production but have grown more extreme in Q2 of 2022. The graphic below (left) shows that mid-priced vehicles ($15,000 – $30,000) are not as available as higher-priced alternatives. This is further complicated by the production capability of independent manufacturers themselves. Generally, domestic brands see longer days of supply on average (more time spent on dealer lots) and are more readily available than foreign manufacturers (below right).

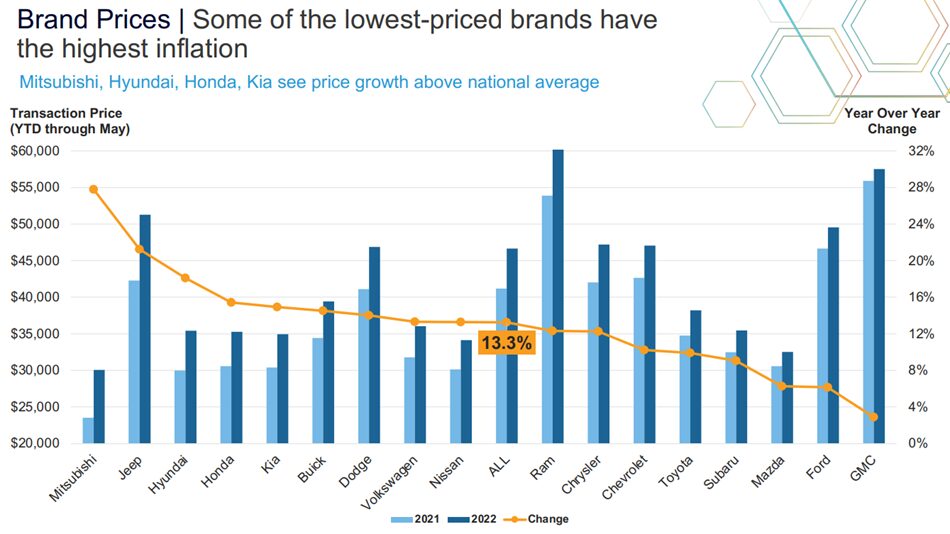

The cumulative effect has created significantly different changes in retail pricing from vehicle to vehicle, further complicating claim handling and salvage valuation. While all retail pricing is up 13.3%, the rate of change for foreign economy class vehicles made by a manufacturer like Mitsubishi is up 28% year over year, while GMC retail pricing is up less than 4% (below, source Cox Automotive Mid-Year report).

As a result, the policy vehicle mix significantly affects average salvage returns and purchase price at auction. Insurers with more significant percentages of high-value vehicles (and high ACV replacement costs) are insuring vehicles with more minor retail pricing changes, more available inventory, and lower returns on total loss resolution at salvage auctions than insurers who have policy vehicles that are lower in average market value and as a result higher auction returns against claim settlement. Foreign economy class vehicles are selling at a premium in retail, wholesale, and salvage spaces while domestic high-cost cars are not. Across the industry, some providers continue seeing increased returns while others are seeing decreases in salvage recovery. The actual vehicles you insure are likely to significantly impact your salvage results more than the market itself at present.

In the meantime, we will continue monitoring auction results and assessing salvage valuations individually. Please continue to send us salvage quotes to assist your claim handling practices.

Here is a summary of the auction return results for June:

3,761 Total Vehicles Sold with a gross return of 26.4%

$1,526,375 in auction increases realized for an increase to gross (MAST factor) of 2.25%

Average gain of $901.05 per initial rejected bid and a success rate of 92.0%

$6,653,287 cumulative net return dollars (after MAST investment) realized YTD for 2022.

Auction Management Wins of the Month

Vehicle segmentation in market research will identify inconsistent market fluctuations and avoid undervalued settlements. This 2021 Toyota Sienna illustrates the current pricing fluctuation across brands, as recognized in the Cox Automotive report mentioned in the paragraphs above. Foreign economy class vehicles have experienced more significant pricing increases year over year relative to domestics. The initial auction run brought 35.64%, in line with historical average return expectations for this vehicle class and loss type. However, today’s pricing trends indicated that the initial high bid was 11.33% below fair and reasonable market value. A decision to reject the initial bid was triggered during the MAST auction management, and an additional $4,625 was recovered for this provider.

Prioritizing specific units for an on-site review impacts accuracy and increases the bottom line. The original auction run brought 11.9% of ACV, possibly a fair return for a 26-year-old camper with side panel damage and broken seals. Just like any marketplace, external factors can influence demand. In this case, the summer season affected pricing and impacted our reserve expectation. An in-person review confirmed the exterior damage did not penetrate the interior walls, and with no water leaks present, repair costs are lessened. This 1996 Coachman 5th wheel was sold to an online bidder the very next day for a 145.6% increase from the initial high bid.

If you are anticipating an owner-retain conversation or dealing with a borderline constructive total, we encourage your representatives to email us at [email protected] for a detailed quote specific to the loss vehicle’s make/model.